Broadstone demonstrates the hidden trap that could sting many pension savers looking to temporarily opt-out of their contributions to support them through the cost-of-living crisis.

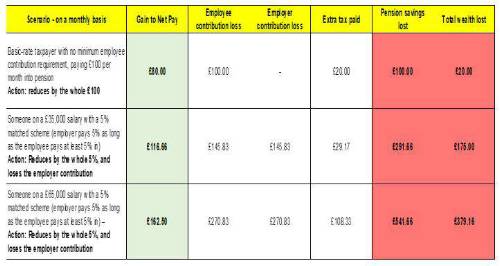

Take the example of someone on a £35,000 salary with a 5% matched scheme (where the employer pays 5% as long as the employee pays at least 5% in) who reduces their contribution by the full 5% and consequently loses the employer contribution.

While they would be reducing their employee contributions by £145.83, they would not see all that money added to their net pay. The loss of tax-relief means that they would only add £116.66 to their monthly salary – with the £29.17 additional tax costing them £350.04 over the course of the year.

Moreover, losing the employer contributions means that their total monthly pension contribution – which would have been £291.66 including employee contributions, employer contributions and tax relief – falls to zero, meaning a total loss to their overall wealth of £175 every month.

The findings are even starker for higher earners who still might be considering temporarily opting out or cutting back on their contributions.

A person on a £65,000 salary with the same contribution set up and reduction as the previous example would be reducing their employee contributions by £270.83, with a total monthly less to their pension savings of £541.66.

However, the gain to their monthly net pay would be just £162.50 a month – a decrease to their total wealth of £379.16 – and a tax-relief gap of £108.33 between the reduction in their employee contributions and the benefit to their monthly salary income.

Previous research from Broadstone found that a 25-year-old on an average salary could miss out as much as £60,000 – or a quarter of their total pension saving potential – if a 2% reduction in employee contributions became permanent.

Rachel Meadows, Head of Pensions and Savings at Broadstone said that it was vital employees were fully aware of the consequences of reducing their contributions, commenting: “For some people, taking the decision to reduce or stop their pension contributions will be necessary as income pressures intensify.

“However, pension savers should be aware that there are traps and consequences due to considerable employer and government incentives around pension saving. It is not as simple as recouping the pension outgoings on their pay-slip pound-for-pound into their salary.

“Indeed, opting out of their pensions may provide some short-term succour but will significantly reduce their total wealth accumulation every month, exacerbated by lost compound investment growth. It is why we are making three clear pleas to employers in the face of growing noise around employee opt-outs.

“Firstly, engagement and education are key. Group sessions for employees that clearly outline the benefits of pension saving and contextualise it within the wider lens of personal finances and wellbeing are crucial.

“Secondly, employers and schemes must maintain records of those staff who do decide to reduce contributions. This means once income pressures subside, they can ‘nudge’ savers every year to encourage them to restore payments back to at least recommended levels.

“Finally, we hope employers can apply rapid pragmatism to their pension scheme rules to ensure that employer contributions are not reduced (or even ceased completely) if employees need to reduce their own pension savings levels in the face of cost-of-living challenges.”

|