By Fiona Tait, Technical Director, Intelligent Pensions

The vanishingly small remainder join DB schemes or other trust-based DC arrangements.

This is a viewpoint supported by the Pensions Regulator (tPR) and, unsurprisingly, the master trusts themselves. In tPR’s response to the report, David Fairs confirms their desire to see an acceleration in the consolidation of small schemes, having found that a number of pension schemes are not meeting even the basic standards of governance and some “particularly at the smaller end of the market” will never have the capacity to do so.

Larger schemes, it is argued, don’t just produce economies of scale, they are also likely to have better governance procedures and access to a greater range of diversified investments, all of which could lead to larger pot sizes at retirement.

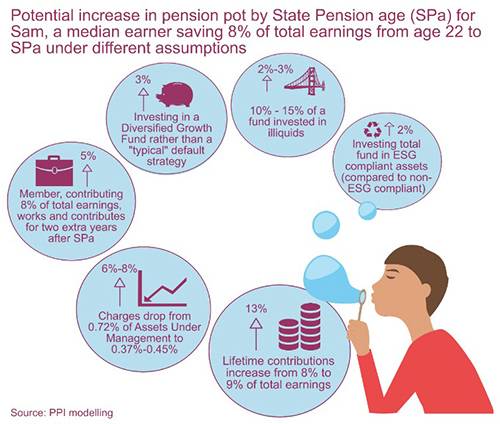

Basing their calculations on the mythical average scheme member – in the personification of Sam, a median earner - the PPI suggests that these factors could, taken together, increase pot size by around 13-16% over a 40+ year working life (breakdown shown in the diagram). Basing their calculations on the mythical average scheme member – in the personification of Sam, a median earner - the PPI suggests that these factors could, taken together, increase pot size by around 13-16% over a 40+ year working life (breakdown shown in the diagram).

How will this work

1. Investment

Diversified growth funds offer an alternative de-risking strategy to lifestyling which is intended to protect members against the higher volatility of equities, while still allowing some potential for growth. This also suits members who want to retire more gradually and who are twice as likely to remain in drawdown rather than buying an annuity. Investing in property and other illiquid assets provides further diversification as well as high-yield income streams, making it ideal as a long-term investment for larger schemes who can manage the up-front capital investment and align returns to required income streams.

2. Governance

Good scheme governance is intended to result in better value for money (VFM) for scheme members. Unfortunately, VFM is notoriously hard to define and even harder to measure and the focus to date has largely been on lowering management charges. Lower charges certainly help. The PPI modelling shows that reducing charges from the current average ongoing charge, 0.72%, to the average applicable to trust-based DC schemes with a thousand or more members, 0.37%, could improve outcomes by up to 8%. There are however, other considerations.

Much emphasis has been placed recently on environmental, social and corporate governance (ESG). ESG investments not only concentrate on firms which are well run and - at least in theory – are likely to do well, they may also help to improve member engagement with their funds. Research by the Defined Contribution Investment Forum found that 63% of members surveyed would feel more positive about their pension and 40% say they would invest more if they knew their money was being invested in a responsible investment.

Other factors which also come under the umbrella of governance but where the impact is extremely hard to quantify include, ensuring that scheme administration is efficient and that member communications help them to understand and engage with their benefits. This is important because the greatest increase to future pot size does not result from reduced charges or improved investment decisions, it comes from member behaviour and, in particular, how much they choose to save.

3. Contributions

The PPI reports that basing contributions on total rather than band earnings, as recommended by the government’s review into automatic enrolment, and increasing the minimum level from 8% to 9% could increase Sam’s pot size by a proportion, 13%, which is more or less equal to the effect of all the above factors put together. Working for two extra years could further increase his pot size by 5%.

This is the game-changer and, unfortunately, still the hardest to deliver. ESG investing might help but financial education and behavioural nudges will probably do more. Financial education courses among adults improve financial capability by around 27% on average however, only 15% of employers currently offer them.

At the end of the day, the size that really does matter for DC savers is the size of their individual pot at retirement and if any, or all, of these strategies mean their pot is likely to be bigger, they should be given serious consideration.

|