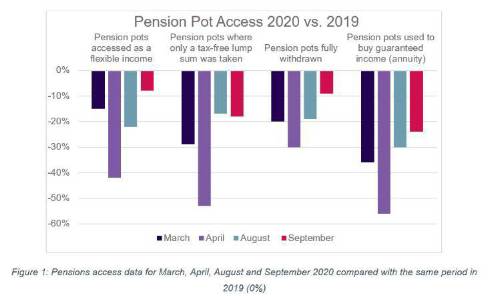

An increasing number of pensions savers have started to withdraw funds after many pressed pause at the start of the pandemic. Comparing data when restrictions were eased in September to April, when the country was in full lockdown:

The number of people taking only a tax-free lump sum has increased by 55%.

The number of people withdrawing all of their pension in one lump sum increased by 94%. This increased by 51% during the same period in 2019.

The number of people buying a guaranteed income for life (annuity) increased by 41%.

The increase in withdrawals is due to a combination of factors including some people returning to withdraw after pausing earlier in the year due to stock market volatility and some people needing the money after a change in circumstances.

The ABI has been monitoring people’s behaviour around pension withdrawals throughout the pandemic. Data from August and September shows withdrawal levels are getting closer to levels seen in 2019 but many pension savers are still resisting the urge to raid their pension pots in the face of continued financial uncertainty.

The ABI is urging anyone considering accessing their pension to seek impartial financial guidance from Pension Wise or regulated financial advice, and to ask their provider about their options.

Rob Yuille, Head of Long-Term Savings at the Association of British Insurers said: “Government restrictions, stock market volatility and employment prospects are just some of the factors weighing on pension savers’ minds when considering taking money out of their pension pot. Everyone is different and it is important to find the right solution for your circumstances. Getting financial advice or guidance can help provide options and clarity on what to do with your savings.

“We welcome the Money and Pensions Service confirming that they will develop a later life checklist for over-50s, especially those facing redundancy or income reductions in light of Covid-19.”

ABI’s Head of Long-Term Savings, Rob Yuille’s top tips on things to consider when withdrawing money from your pension:

Familiarise yourself with the pensions freedoms so you are aware of your options. You can do a lot more with your pension pot than previously. What risks are you willing to take?

Consider the amount of money you will need each month to maintain your lifestyle. Do you want to have annual holidays? Do you still have a mortgage to pay off? What other sources of income do you have, and do you need your pension to keep up with inflation? Could you consider working for longer?

Think about costs later in your retirement. Care needs are not a subject we are comfortable thinking about but it is important to have conversations about it with your family, as well as powers of attorney, wills and inheritance.

Your health and life expectancy. We often vastly underestimate this, but evidence shows we are mostly living longer, with a growing variation in healthy life expectancy. If you have a partner, do you need to provide for them financially after you die, or are you relying on them?

Use sources of help: the government’s pensions tracing service if you think you might have a lost pension pot; a Midlife MOT from the Money and Pensions Service or your employer; and Pension Wise, or a financial adviser.

|