Analysis of yesterday’s Office for Health Improvement and Disparities (OHID) excess mortality data1 by retirement specialist Just Group revealed a sobering rise in the number of excess deaths across England since the Covid-19 outbreak.

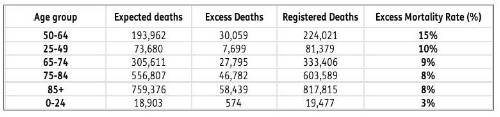

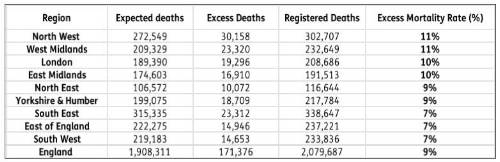

Since the beginning of the pandemic - 27th March 2020 - to 29th December 2023, a total of 2,079,687 deaths were registered in England, among which there were 171,376 excess deaths, indicating a 9% increase in the number of total excess deaths relative to expected deaths (1,908,311) across this period.

When split by age, those aged between 50-64 years old experienced the greatest uptick in the number of excess deaths relative to expected deaths, with an excess mortality rate of 15%. There was a 10% rise in the excess death rate among those aged between 25-49 years old, and a further 9% increase in the 65-74 year old cohort.

Similarly, when looking at regional disparities in excess mortality rates, the North West, West Midlands, and London saw the most significant rise in excess deaths since the pandemic, surging by 11%, 11% and 10% respectively.

These findings were corroborated by last week’s harrowing life expectancy data2 which demonstrated that between 2020 and 2022, the life expectancy at birth in the UK was 78.6 years for males and 82.6 years for females, marking a drop of 38 weeks from 79.3 years for males and 23 weeks from 83.0 years for females when compared with pre-pandemic figures (2017 to 2019).

Commenting on the data, Stephen Lowe, group communications director at retirement specialist Just Group said, “Yesterday’s data reveals the scale of the excess deaths experienced from the start of the Covid-19 pandemic in March 2020 and its effect in particular on older cohorts.

“It follows last week’s ONS life expectancy data which showed that higher mortality rates in 2020-22 had set back improvements in UK life expectancy by about a decade. These are sobering figures but amid the doom and gloom it is important to remember that historic numbers tell us little about how the future might turn out, especially about how our own individual futures may turn out.

“An average life expectancy figure only tells us an age at which we have a 50:50 chance of achieving, it is not a target. We are as likely to live longer as die sooner. That is why financial planners seek to cover all the eventualities when giving advice to clients so retirement plans can work in all scenarios."

|