Extrapolated nationally, Brits have £43.1 billion worth of garden goods – ranging from furniture to BBQs and works of art – in their outdoor spaces. This research has identified that £16.8 billion of these goods are likely to be uninsured, despite respondents reporting an increase in theft from outdoor spaces.

Last year’s research identified that a quarter (25%) of Brits had experienced garden thefts. This figure has spiked to 41% just a year later, averaging £177.40 worth of goods stolen in each instance. Those in the South West suffered the highest losses, with an average of £210.20, compared to a low of £112.80 in the North East.

This reported rise in crime is converse to the drop in those buying relevant insurance. Nearly two-fifths (39%) haven’t insured garden goods bought in the last year, an increase of 7% on 2021, suggesting that despite a significant increase in the value of items purchased, Brits are becoming less inclined to insure the items in their gardens. The Scottish were least likely to have insurance for items in gardens (41%), compared with 92% of Londoners.

Uninsured Brits lose out

Overall, 82% Brits who have had items stolen from their gardens had insurance. Of those who had insurance, 33% claimed for the stolen items, while 14% did not claim at all, and 30% claimed something.

Reasons given for not insuring garden goods range from the 63% who didn’t think it was necessary to insure items that were subsequently stolen (rising to 83% among 18-24 year olds) to the 18% who wrongly thought the items were covered by their home insurance. The research found that 13% simply forgot to insure items in their garden.

Bikes, furniture, and tools are most stolen

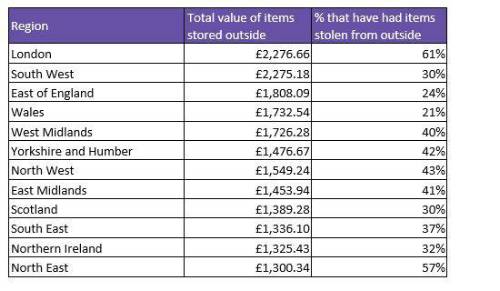

Across the UK, the average value of items in a household’s outdoor space is £1,7221.90. London has the highest average with £2,276.70 worth of goods, while the North East has the lowest, averaging £1,300.30.

A quarter (25%) of Brits reported bicycles being stolen, making them the most common item to be taken from outdoor spaces. Around 8.6m households (31%) of Brits keep a bicycle in their outdoor space. Those in the East of England suffered 10% more bike theft than the national average (35%), while the North East witnessed considerably less so, at 14%.

Furniture (24%) and tools for DIY (23%) were the next two most common items to be stolen from outdoor spaces nationally. The Northern Irish were most likely to keep tools in their garden (56%), but also the least likely to have them stolen (13%). The Scottish are, by some margin, the least likely to keep a BBQ in their garden (18%).

Among 18–24-year-olds, 80% reported having had something stolen, compared with just 21% of those aged 55-64. Men are more likely than women to have had something stolen (36% v 47%), and also slightly more likely to have taken out insurance (21% v 15%).

London is UK’s garden crime capital

London is the UK’s epicentre of both garden goods value (£2,276.70) and of garden theft value (£207.30). Of the Capital’s respondents, 61% report having had something stolen from their outside space. At the other end of this spectrum is Wales, where 21% of respondents have had something stolen, with an average value of £184.40. ???????

At 26%, Londoners were more than twice as likely as the national average of 11% to keep art in their outdoor space (26%). Those in the Capital were also most likely to have art stolen from their outdoor space (31%), compared to just 4% of those in the West Midlands.

Jo Thornill, Money Expert at MoneySuperMarket, said: “Two years at home seems to have given many people a real taste for the outdoors and collectively we now have billions of pounds worth of goods in our gardens. The sad fact is that thieves can see garden goods as an easy target, so the reported rise in garden theft is perhaps unsurprising. But concerningly this does not correlate with a rise in people insuring their garden purchases.

“A significant number of people think their home contents insurance covers their garden, but this is not always the case. Your home insurance may provide some level of garden cover, but it’s always wise to check what is included when you take the policy out, or when you make a big purchase for your garden.

“At MoneySuperMarket, we’re on a mission to help the nation to save £1 billion on household bills by giving Brits access to the tools and information they need to inform their financial decisions. When you’re checking what is covered by your existing home insurance policy, it is worth comparing to see if you could get a cheaper premium elsewhere.”

|