By Chris Pritchard FIA, Principal and Co-Head of Insurance Investment at barnett Waddingham

There are many cryptocurrencies, but we focus on bitcoin due to its finite supply, established network effect, growing adoption narrative, and decentralised protocol. For a broader discussion on digital assets, see our blog covering the differences between cryptocurrencies and blockchain.

Two sides of the coin: Bitcoin vs. conventional money

Bitcoin’s uses have been debated for many years. Critics argue that bitcoin lacks intrinsic value and is a purely speculative asset while proponents highlight its monetary properties, comparing it to gold and fiat currency (currencies issued by governments like the dollar, euro or pound).

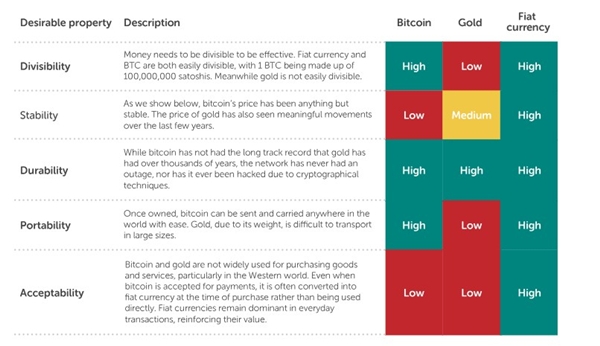

Below, we summarise the desirable properties of a globally adopted currency and whether bitcoin, gold and fiat currency have these properties.

The challenge of acceptability

The acceptability of bitcoin remains a major hurdle. In the Western world, modern banking systems have made fiat transactions seamless, requiring nothing more than a phone to transact anywhere, anytime. This convenience reduces the incentive for individuals to switch to bitcoin for everyday use. More importantly, bitcoin lacks global acceptance as a widely used form of money. Without the ability to conduct daily transactions on a broad scale, its viability as a true currency remains highly limited.

Scarcity: A double-edged sword?

Scarcity is built into the bitcoin network, with the maximum supply being c.21 million bitcoin which will be reached in 2140 (and in practice the number of bitcoin is already close to 20 million). By contrast, fiat currencies can be expanded by central banks.

Proponents of bitcoin as a viable currency argue that scarcity is a fundamental characteristic of sound money. There is also an argument that scarcity may help drive value, and the lack of scarcity detracts from value as has been seen in rare cases of hyperinflation in countries around the world.

However, those opposed to bitcoin as money would argue the ability of central banks to flex the supply of fiat currencies has helped in times of crisis, such as the great financial crisis and the Covid-19 pandemic. We fall strongly in the latter camp. A modest amount of inflation is positive for growth and encourages consumption whereas deflation encourages hoarding of money and deferment of consumption.

While bitcoin shares some monetary properties with traditional currencies, its lack of global acceptance and extreme volatility mean we do not believe it functions as a viable currency today.

Could bitcoin become a store of value?

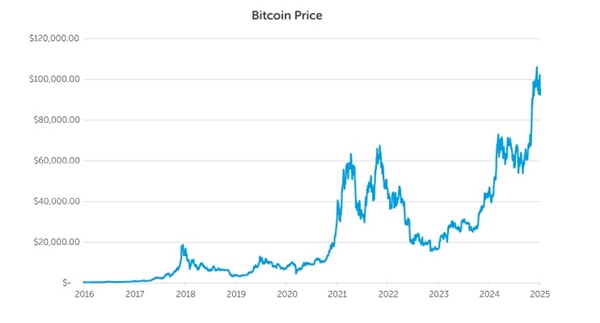

The other narrative which gained traction in recent years, is that bitcoin is, or at least will be, a store of value. How well has value has been stored so far?

There is no doubt that past performance has been volatile and the above graph does not support the store of value claim. The store of value characteristic presents itself when the asset is more widely adopted for that use and the volatility in price reduces.

Those who advocate for bitcoin would argue a key driver of its potential as a store of value is its scarcity, similar to gold. However, key differences exist:

Gold has real-world utility such as in electronics and jewellery. Its $19tn market cap is mainly driven by its acceptance as a store of value and an alternative for central banks to hold instead of the US dollar. Gold’s short-term supply adjusts to price. If the price of gold falls, then gold mines will become uneconomical and close, reducing the supply and supporting the price. If bitcoin falls in value then miners stop mining but the difficulty adjustment for the algorithm will then make mining easier and more economical, meaning the supply keeps coming.

So, could bitcoin be used as a store of value? Definitely not at the moment – the price is far too volatile. One day? Possibly – the narrative is building momentum, but we see it as unlikely given there is no secondary use case for bitcoin, and, as mentioned above, scarcity and acceptance are both barriers to bitcoin acting as a widely accepted currency.

Is bitcoin’s price driven by speculation alone?

Evidence suggests that speculation is indeed the primary driver of bitcoin's price. While narratives around store of value and institutional adoption are developing, bitcoin’s valuation is still fuelled by speculative trading rather than fundamental utility. The speculation is that bitcoin will become a store of value and that governments will change laws and purchase it. And if you believe this will happen, and you buy bitcoin, you may benefit from the price appreciation following these events. But this does not come without risk for those investing.

Key challenges for bitcoin as an investment

Bitcoin as an investment has received challenges by market participants over the years. With all new investments scrutiny and challenge is very important. We set out some of those challenges below.

Challenge 1: Bitcoin's performance is driven by speculation

Bitcoin's price exhibits considerable volatility, with its valuation primarily influenced by anticipated future adoption rather than current utility. While some investors see this as an opportunity, it presents significant risk, and not one that we are actively taking to our clients at time of writing.

Challenge 2: Energy consumption

Bitcoin mining consumes a significant amount of energy, which has led to criticism from those who question its role in the global economy. However, whether this energy usage is justified depends on bitcoin’s long-term importance. If bitcoin becomes a widely adopted asset, its energy consumption could be seen as a necessary cost of securing a global financial network — much like the infrastructure supporting traditional banking systems.

It’s also important to note that bitcoin mining is increasingly powered by renewable energy. Many large-scale mining operations now help stabilise renewable power grids by using excess energy that might otherwise go to waste. It is difficult to estimate exactly what proportion of bitcoin is mined using renewable energy sources but some estimates put this at as much as 50%.

Challenge 3: Association with illegal activities

Bitcoin’s pseudonymous nature has led to concerns that it is widely used for illicit transactions. While it is true that bitcoin has been associated with illegal activity, measuring the extent of this use is challenging. Estimates vary significantly, with some studies suggesting that illicit transactions make up less than 1% of total bitcoin activity, while others suggest it could be as much as 50%.

However, if regulatory oversight increases and more legitimate institutions engage with bitcoin, its use in illegal activities is expected to decline as a proportion of total transactions. That said, investors should be aware of bitcoin’s historical association with illicit trade, even if its role in such activities may be overstated.

Challenge 4: Superseding risk

Bitcoin did not exist 20 years ago. There is a risk that another, superior, digital store of value (or even currency) comes along that replaces bitcoin rendering it close to worthless.

Should institutional investors consider bitcoin?

Given these challenges, we do not believe bitcoin is a suitable investment for UK pension schemes, charities, or endowments due to its volatility and uncertain future. The risks to funding levels and long-term financial planning are significant.

However, for investors with high risk tolerance (such as family offices), an understanding of the risks involved, and a strong belief in bitcoin’s future, a small, carefully managed allocation could be considered as part of a well diversified portfolio.

|