While the Bank of Mum and Dad is one of the UK’s largest lenders, Direct Line’s research suggests that it needs a bailout from the Bank of Son and Daughter, as the impact of reduced salaries (15 per cent) and unexpected unemployment (12 per cent) leads many parents to try and find income elsewhere. In fact, nearly eight million parents (23 per cent) have had to dip into their child’s savings since lockdown began. On average, each family has needed around £700 from their child’s savings account, which equates to a total sum across the UK of nearly £17 million for every day of lockdown.

Unfortunately, the lasting impact of the pandemic means families expect to take even more from their children’s savings in the future. On average, families predict needing to withdraw £862 from their children, which equates to a total of £3.4 billion to help keep them afloat during these difficult economic times.

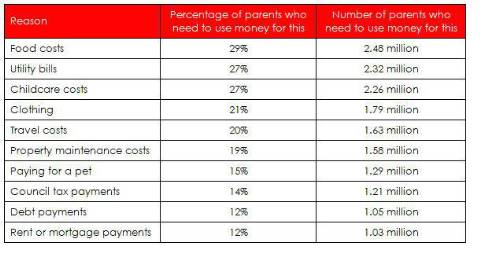

Day to day living costs are the driver behind parents needing to access their child’s savings, with nearly a third (29 per cent) doing so to pay for food costs and similar number using the money for utility bills (27 per cent) and to help cover childcare (27 per cent). One in eight (12 per cent) have struggled to pay their mortgage or rent or keep up with debt repayments during lockdown and have needed help covering these costs.

Table one: Reasons for parents using children’s savings

The impact of coronavirus on children’s savings could be profound, as not only have parents had to use existing savings but many have also had to stop their regular payments. Overall, more than a quarter (27 per cent) of parents have had to stop regularly setting aside money for their children since the beginning of lockdown, some 9.3 million people.

On average, parents used to set aside around £130 a month for their children. While many parents saved money for their children to spend as they wish (39 per cent), others started saving for something specific for their child’s future, like a property deposit (27 per cent) or to help cover university fees (24 per cent). One in six (16 per cent) wanted this money to help their child buy their first car.

Unfortunately, over a fifth (22 per cent) of parents don’t believe they will be in a position to replenish lost savings in future which means children’s savings accounts across the country will lose an estimated £960 million between September and December 2020 alone. This could have a serious long-term impact if money was set aside to help with a child’s future.

Chloe Couper, Business Manager at Direct Line Life Insurance, commented: “The impact of the coronavirus pandemic has been severe and unfortunately means many families are facing tough financial decisions. Widespread redundancies, furloughing and pay reductions have resulted in many households across the country having to cope on a lower income and try to reduce their spending. While it is understandable that parents feel they need to utilise any savings they and their children have to cover costs, this could have a negative long-term impact on their children if this money was being set aside for things like university fees or property deposits.

“2020 has shown us that worst case scenarios sometimes happen, and we may not know what’s around the corner despite best laid plans. Many people will now be thinking about the future and how they would provide for their family if anything happened to them and a life insurance policy can help provide this peace of mind.”

|