*Data source: Employment, unemployment and economic inactivity for people aged 16 and over and aged from 16 to 64 (seasonally adjusted) –

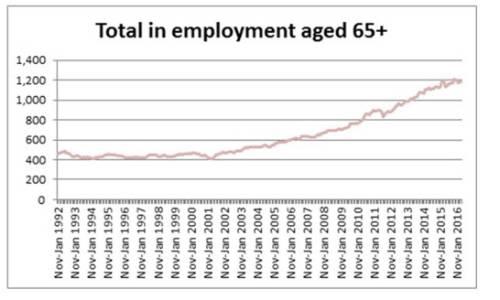

Commenting on the figures, Stephen Lowe director at specialist financial services group Just Retirement, said: "This analysis confirms that more people are working past the traditional retirement age of 65. That figure appears to have plateaued at around 1.2m which may be of concern for around one in four of 40 to 45 year olds, whose intention is to continue working post age 65 to generate income to sustain their lifestyle.

“Working longer will be a solution for some people seeking to avoid a drop in their monthly income as they transition into relying on pension income, but these figures suggest that the job market is no less competitive for those over 65. Following the introduction of the government’s Pension Freedoms we have seen a significant increase in the number of people in their 50s withdrawing cash lump sums from their pensions, but it is vitally important that people do not lose sight of the central purpose of a pension, which is to generate an income to replace the loss of wages when they stop working. People need a guaranteed level of income to ensure regular bills can be paid each month.

“Pension Wise, the government’s free, impartial guidance service is available to help retirees make informed decisions about how to access and use their pension savings, but it is not compulsory and those who choose not to use it or seek regulated financial advice face a myriad of difficult decisions by going it alone. The challenge for government policy makers, regulators and the pension industry is to encourage good decisions as people transition into retirement, overcoming the mistakes of the past that saw millions of savers fail to shop around and switch pension providers to ensure they attained the most competitive income in retirement.

“Given only one in five people are using Pension Wise there is a case for making it the default option, requiring people to opt-out rather than opting in, in the same way as auto-enrolment operates. It is essential help is provided to increase the probability that people will make a good choice and attain the best value available. The current policy is not delivering that outcome.”

|