Dean Butler, Managing Director for Retail Direct at Standard Life said: “As of last Saturday, workers will see their rate of National Insurance (NI) contributions cut from 12% to 10% (or to 8% for those who are self-employed), providing a welcome boost to their pay packet. As a result, someone earning an annual salary of £30,000 will have an extra £348 in their pocket each year.

“While it’s tempting to see this as extra spending money, it’s worth trying to save at least a portion of it. Banks are offering inflation-busting interest rates on savings accounts at the moment so putting away additional cash could pay off. If you’re able to prioritise long-term savings, then you could consider using the money you get each month to top up your pension contributions - even small additional contributions now could give you a big retirement boost.

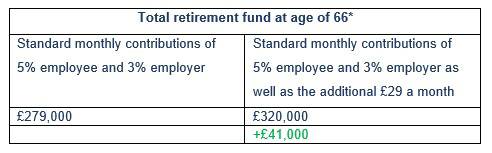

“For example, for someone earning an annual salary of £30,000 per year throughout their career from age 22 to 66, putting that additional £29 a month into their pension would lead to an additional £41,000 in retirement, not adjusted for inflation.”

*assuming £30,000 salary per year, and 5% a year investment growth. Figures are not reduced to take effect of inflation. Annual Management Charge of 1% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

|