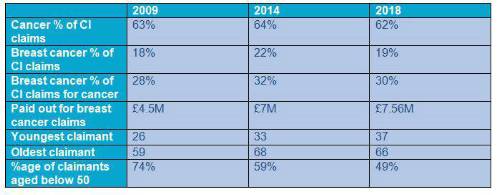

While cancer made up 62% of all CI claims Aegon received in 2018, breast cancer on its own accounted for 30% of these cancer claims – making it the biggest single cause for a customer to claim on their Aegon CI policy.

Simon Jacobs, Head of Underwriting and Claims Strategy at Aegon UK said: “For several years now, breast cancer has been the biggest single cause of critical illness claims that we receive at Aegon, and 2018 was no different.

“In the last 10 years, we’ve provided financial support to more than 750 women diagnosed with breast cancer, paying £61.2 million in critical illness claims to help them through their diagnosis and treatment. Fortunately, early detection and better treatment means that survival rates after a diagnosis of breast cancer are improving.”

Jacobs continued: “Financial pay outs help families make ends meet so people can focus on their treatment and recovery, but it’s only one of the benefits to having a critical illness policy. There’s also the need for practical and emotional support, which can often be the more immediate priority. Financial support will help to some degree but the best protection policies provide both a financial and emotional crutch.

“We provide our protection customers with access to Policy Plus, which includes a health and wellbeing service, throughout the lifetime of their policy. There’s a wide range of support available 24/7, 365 days a year, with trained counsellors offering help and support with concerns about health, work-related stress or even family issues such as marital differences or children’s behaviour.

Forty per cent of calls to our health and wellbeing service in the past year have been in relation to mental health*.

“It can be a huge weight off someone’s shoulders to be able to share any anxieties they might be feeling following a diagnosis or during treatment of breast cancer or any other critical illness, in complete confidence. Sometimes people just don’t feel comfortable speaking to close family and friends for fear of burdening or worrying them.”

The numbers: Aegon critical illness cancer claims

To find out more, Aegon has produced a factsheet to provide customers with information and support material: Spotlight on breast cancer

|