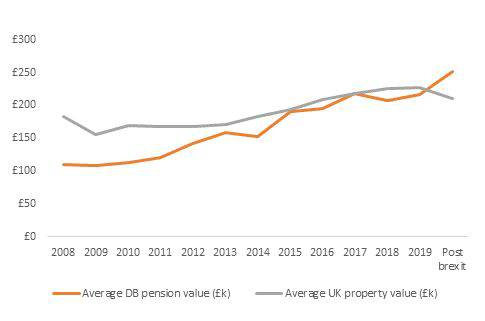

Commenting on the analysis of, Ross Fleming, co-head of DB Investment, Hymans Robertson, says: “Figures from the ONS show that UK property prices are on the precipice of decline with Brexit on the horizon as the economic outlook remains uncertain. Our analysis shows that DB pensions, on the other hand, are expected to be more resilient than property in the near term, particularly if there is a no deal Brexit scenario.

“We analysed the expected financial impact of Brexit which, as has already been widely reported, is expected to lead to greater economic uncertainty in the near term. In times of greater uncertainty when interest rates fall, DB pensions increase in value. Conversely property prices are more likely to fall. In fact, if no-deal was the outcome, it could mean that for the first time DB pension pot values are likely to be significantly higher than average property values. They could, potentially, rise in value by 25% relative to property. “ (as shown below.)

Commenting on the significance of DB pensions values being higher than average property values, Ross Fleming continues: “This could see people facing a situation where their DB pension pot is worth significantly more than their home. So much focus is put on property as an individual’s main asset, but those fortunate enough to have a DB pension may well be surprised that it is worth more. They may see its value becoming higher than the value of their home from October. It is vital that those with a DB pension recognise how valuable this important financial asset really is and make plans for what they will do with it. In the post pensions freedoms world scheme members have a lot more choice about what to do with their pension pot.

“If this becomes their biggest financial asset, engaging early with the scheme and seriously considering taking financial advice to determine the best course of action becomes even more important.”

|