The state pension currently pays out £8,546 a year which can be a significant part of an individual’s income in retirement. For some, they may feel they’ll be unable to retire until it kicks in. And unlike private and workplace pensions, where people can start drawing an income from age 55, there’s no ability to take your state pension early.

Recent research from Aegon showed that 40% of people don’t believe they should be forced to work longer to reflect improvements in life expectancy. And with some advance planning, this shouldn’t be necessary.

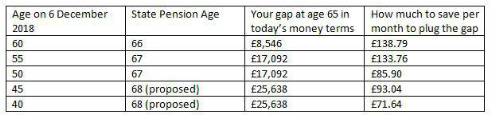

The key is to save extra to ‘bridge the gap’, replacing the amount which will no longer be received from the state between age 65 and your new state pension age. The amount you need to pay extra to bridge the gap varies with your current age. This determines from what age you’ll receive your state pension and how many years you have to save.

Steven Cameron, pensions Director at Aegon said: “With the new pension freedoms, people are increasingly personalising how and when they take a retirement income from their workplace and personal pensions. However, there’s no ability to take your state pension early and the age it can be taken is starting this month to go up to 66 with further increases to 67 and 68 due in coming years. While the state pension on its own won’t provide a luxury retirement, for many people it’s a significant part of their retirement income. Many may feel they can’t afford to retire until it kicks in, which could mean working longer as state pension age rises.

“However, this can be avoided with advance planning by putting aside some extra money every month into a private or workplace pension. The extra funds built up can then be used to ‘bridge the gap’ between age 65 and when state pension starts.

“For someone aged 60, replacing the state pension between age 65 and 66 might cost £138.79 a month for 5 years, which allowing for the tax relief bonus from the Government would mean a cut in take-home pay of £111. Individuals currently aged 50 will have to wait until age 67 to receive their state pension, and for them, bridging the gap will cost £85.90 a month for 15 years, or £68.72 from take home pay. Some employers will match employee contributions, so it’s worth checking of your employer will pay a share of this.

”These figures are an indication of what it will cost solely to replace state pension between age 65 and the new state pension age. It’s always worth seeking advice on your broader retirement planning to check you’re on target for the retirement you aspire to.”

Assumptions underpinning the figures

The figures assume the state pension increases in line with prices. At present, the state pension increases in line with a ‘triple lock’, or the highest of price inflation, earnings inflation or 2.5% each year. There is no commitment to continue this beyond the current term of parliament, but if it continues, state pensions could increase faster than price inflation making the ‘gap’ larger. Investments are assumed to grow at 4% after charges with contributions increasing in line with inflation, assumed at 2.5% a year.

|