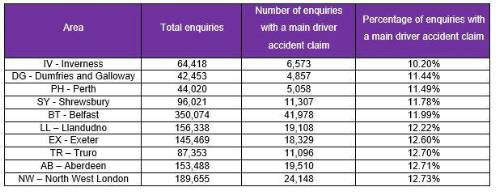

The in-depth research analysed over 21 million car insurance enquiries by location to reveal the percentage of main driver claims which featured an accident. Only 10.20% of car insurance enquiries by Inverness drivers featured a main driver accident claim. Dumfries and Galloway (11.44%) and Perth (11.49%) took the remaining spots in the top three, followed by Shrewsbury (11.78%) and Belfast (11.99%).

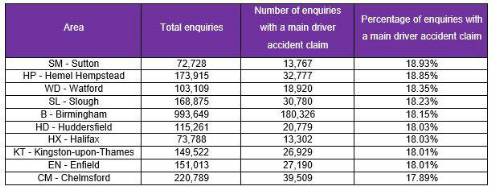

At the other end of the scale, the London Boroughs of Sutton and Hemel Hempstead are home to some of the worst drivers in the UK with almost a fifth (18.93% and 18.85 respectively) of enquiries including a claim, closely followed by drivers in Watford (18.35%) and Slough (18.23%).

Top 10: Britain’s best drivers by area:

Bottom 10: Britain’s worst drivers by area:

When looking at age, older drivers are the least likely to be in a road accident, with just 15.03% of those in the 65+ age bracket making a claim as a main driver. Those in the 20 to 24 year-old age group (17.56%) are most likely to have a main driver accident claim.

Kate Devine, car insurance expert at MoneySuperMarket, commented: “Our research confirms that cities and towns in more rural locations tend to have a lower overall rate of main driver accident claims than places in more developed areas.

“This is important because it can impact the level of your premium in a couple of ways. Firstly, insurers consider a range of factors when giving you a quote – including your postcode – so if you live in an area associated with a high rate of accidents, or indeed thefts, you could pay more. Secondly, when you declare an accident that you’ve claimed for in the past, insurers will likely view you as more of a risk which could lead to a higher premium quote.

“Whether you have made an accident claim on your policy or not, the good news is that you don’t have to settle for high premiums. Make sure you don’t let your policy automatically renew – shopping around could save you up to £2182 per year by switching to a cheaper policy. And if you really want to bank the best savings, purchasing your policy between 15 to 28 days before your renewal date can save you as much as 17% on the price you’d pay than if you renewed closer to your policy end date.”