• Despite Briton’s obsession with the weather at home, over 9 million people don’t consider severe weather issues prior to booking an overseas holiday

• 852,227 holidaymakers are affected by extreme weather annually1

• When choosing a travel insurance policy, 43% of respondents do not consider if it would cover delayed flights, cancellations or holiday interruptions due to severe weather

One in ten holidaymakers has been impacted by extreme weather in the last five years, equating to some 852,227 people affected annually1. Of those who were affected, some had to stay in their destination for longer as a result (50%) while others had their holiday cancelled before they left (33%) or had to leave their holiday early (23%).

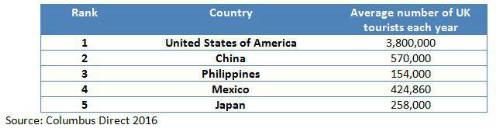

According to the latest foreign travel advice published by gov.uk, more than five million British tourists travel to the countries most regularly affected by tropical cyclones each year (with some 3.8 million Brits visiting the US annually)4. Yet just 43% of holidaymakers would consider whether it is hurricane season before booking their holiday.

Table one: Countries most affected by tropical cyclones (typhoons) / hurricanes5

Rob Thomas, Head of Brand & Performance at Columbus Direct said: “Bearing in mind the impact that severe weather can have on a holiday, we strongly recommend that travellers check the typical weather conditions of their destination at the time of their travel before booking their holiday. Off-peak holidays are often cheaper but check that this is not because it is hurricane, monsoon or tornado season. The government provides foreign travel advice broken down by country which has a useful overview of severe weather affecting different geographies.”

Of those who were affected by extreme weather in the last five years, one in eight (12%) did not have any travel insurance. Two fifths of those (40%) who had a travel insurance policy was able to claim cover for all aspects of their holidays affected by severe weather while more than a quarter (28%) was covered for some aspects. One in ten (10%) failed to claim cover for the incident. There could be different reasons for declined claims, such as delays didn’t exceed the minimum duration or inadequate documentation for trip cancellation reasons and expenses.

When choosing a travel insurance policy, just one in three (32%) holidaymakers would consider cover for delayed flights and travel delays due to extreme weather and only a quarter (28%) would check their policy had cover for cancellations to their holiday. 43% of the respondents said they would not consider whether the policy would cover delayed flights, cancellations or holiday interruptions due to weather impact at all. One in seven (14%) of British holidaymakers admit to not taking out travel insurance.

Rob Thomas continued: “While we can try to minimise our risks of being confronted with severe weather issues at our holiday destinations, we might still find ourselves caught up in such situations. Anyone going away should take out comprehensive travel insurance as soon as they have booked their holiday to ensure that they are covered in the event of extreme weather ruining their plans. It’s also worth noting that while airlines need to look after passengers in the event of flight delays, they are not legally obliged to compensate passengers if the service disruptions are caused by extraordinary circumstances such as bad weather.

“Check what is covered before buying your insurance though, there are a vast number of products available but they vary significantly in terms of what they cover and you don’t want to be left out of pocket because you didn’t read the small print.”

|