MGM Advantage, the retirement specialist, is warning that people could face having to work significantly beyond their planned retirement dates to make up for the impact of earnings failing to keep pace with inflation.

Its analysis reveals that the ongoing wage crisis is threatening people’s retirement plans, as lower wage growth has led to smaller pension contributions.

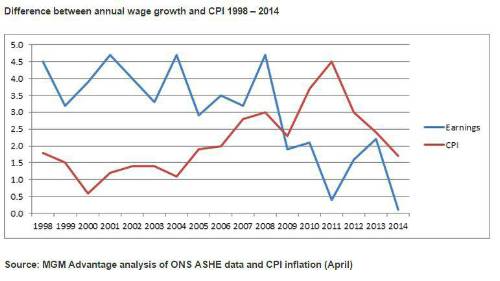

According to official figures1, the UK has seen a protracted period of falling real pay levels between 2009 and 2014, as wage rises have lagged significantly behind inflation. Someone earning £27,200 at the end of 2014could have expected their earnings to be £33,6992 if their wages had kept pace with inflation, a gap of £6,499. This gap in ‘real earnings’ has not only affected the current living standards of many people, but has also affected pension contributions: as salaries have not increased, neither have the size of pension contributions. This potentially leaves a 13% hole in the size of the pension pot at retirement of the average UK worker, meaning those approaching retirement may need to work for an extra two years to make up the shortfall, or accept a lower standard of living post retirement.

Andrew Tully, pensions technical director, MGM Advantage, said:

‘The impact of falling real pay has hit workers hard. It is reducing their standard of living now, and will potentially reduce their standard of living in retirement too. This sleeping giant will only rear its ugly head when people come up to retirement, and means many may have to work for longer than planned, or re-evaluate expectations of their retirement.

‘This is not only an issue for people approaching retirement, but also something younger generations need to think about. For people who do have time on their side, the implications of lower pension contributions are relatively easy to address through making larger contributions now to make up the ‘shortfall’.

‘An open and honest dialogue about the unintended consequences of falling real pay is vital to equip people with the right information to make informed choices and ensure their retirement plans are kept on track.’

Example case study

Jane (aged 30 in 2009), earned the then average UK salary of £25,387. At a total 8%3 of salary, between 2009 and 2014 Jane would have seen her monthly pension contributions increase from £169 to £184 (let’s call that x). If, however, Jane’s pay had kept pace with inflation, her monthly pension contributions would have increased to £225 (let’s call that y).

This doesn’t sound like a huge difference in monthly contributions, just £41, but add fund performance of say 5%, compound that over the 30 years left until retirement and the difference between x and y becomes very large. Assuming Jane retires at 65, the failure of her earnings to keep pace with inflation will leave a £8,329 hole in her pension pot, or put another way, her savings are 13% lower than if her wages had kept pace with inflation.

The reason for this seemingly disproportionate impact is the issue of compounding, or ‘rolling up’ investment returns. Not only are Jane and her employer paying less into the pension for the five years, but there is, each month, less money invested to grow year-on-year until retirement.

Jane faces the choice to work on longer (in her case around two years) to make up the ‘shortfall’, pay a higher contribution into her pension now (around £10 a month) or accept a lower standard of living in retirement from a smaller pension pot.

|