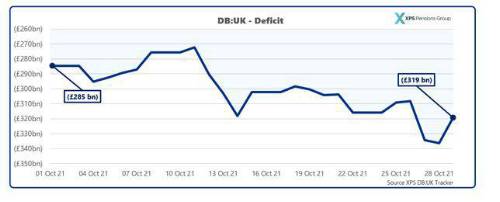

DB:UK tracks the funding position of UK defined benefit (DB) pension schemes on a long-term target basis and allows real time monitoring of changes and analysis of the reasons behind any movement.

What the budget means for pension schemes

Whilst much of the immediate focus of the Budget was on the proposed spending, plans to curb the level of Government borrowing has had the biggest immediate impact on UK pensions schemes. Following the Budget, the Debt Management Office (DMO) issued a statement that the total sales of gilts over the 2021-2022 period will fall by £57.8bn to £194.8bn, a much bigger drop in supply than was expected by markets.

Pension schemes are still driven to invest in long-term gilt market, even though it is already saturated by excess demand, as a result of increasing regulation and as a desire to match their underlying liabilities. The announcement of reduced gilt supply has therefore pushed yields down, causing the value of liabilities to rise, adversely affecting pension scheme balance sheets.”

Impact on investment markets

Other recent communications have covered inflationary pressures, as supply-side struggles and Covid-19 stimuli have led to concerns throughout global markets. Short-term inflation has been felt in the UK and elsewhere, with the CPI experiencing an increase of 3.1% over the year to the end of September. The key for investment markets is how this translates to long-term term inflation, and whether economic growth can be sustained in real terms. Expectations for growth assets will continue to rely on the delicate balance between interest rates and inflation, in conjunction with recalibrating supply chains.

Felix Currell, Senior Consultant, XPS Investment said “Short-term interest rates and inflation are intrinsically linked, however the key focus for pension schemes is on rates at the longer-term. This announcement from the DMO serves as a reminder that supply and demand factors play as much of a role in longer-term yield movement as economic factors. It is important the trustees understand the unpredictability of the risks carried by their scheme, at a time where many individuals were expecting yields to move in the opposite direction.”

What pension schemes can do

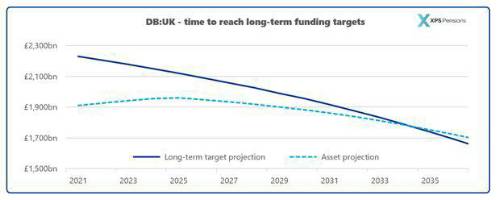

Adam Gillespie, Partner, XPS Investment added “The Pensions Regulator’s draft funding code encourages trustees to look long-term in setting their strategies, which is what drives our work with XPS’s DB:UK Funding Watch.”

“Whilst hedging strategies are commonplace, there is a wide range in how these are executed and how much protection is offered.

For example, there are many reasons why trustees may want to consider implementing hedging targets above the level of technical provisions, for example to protect their schemes against the risks faced in reaching their long-term objectives. A hedging strategy should form a key part of setting an appropriate journey plan to give trustees a smoother path to their long-term goal such as buy-out or run-off.”

|