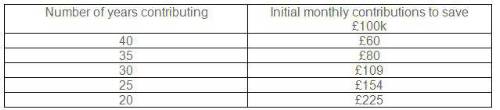

Aegon analysis shows the monthly contributions needed to reach a £100K savings pot over different savings periods.

With 5% investment growth, an initial monthly contribution of just £60 per month rising with inflation for 40 years would create a total fund of £100K.

For those saving into a typical workplace pension, the amount required is only half this as employer contributions as well as government tax relief boost savings.

Aegon analysis shows the monthly contributions needed to achieve a £100,000 fund

Number of years contributing Initial monthly contributions to save £100k

Table assumptions:

5% investment growth per year less charges of 0.75% of fund each year.

Contributions will rise with inflation of 2% each year.

Contributions rounded to the nearest £

The figures show the importance of allowing lots of time for your investments to grow. Someone wishing to build up £100k over 20 years, would need an initial contribution of £225 a month, almost four times as much as someone who saved over 40 years and achieved the same 5% investment growth. It is important to remember, however, that £100k today will buy considerably less in 40 years’ time.

The analysis also shows the benefits of saving through a workplace pension as under automatic enrolment rules, every £1 saved out of take home pay becomes £2 after the employer contribution and the tax boost from the Government. This means that the cost to the individual of building a £100,000 workplace pension pot is just half what it would be if saving on their own outside of a pension*.

Steven Cameron, Pensions Director at Aegon, comments: “Many might think building up a savings fund of £100,000 is completely out of reach. But our analysis shows that provided you get into the savings habit early enough, it could be much more affordable than you might guess.

“For someone starting saving in their 20s, an initial monthly investment of as little as £60, rising with inflation and with investment growth of 5%, could produce £100k after 40 years. And if that same individual is contributing just half this, or an initial £30 from take-home pay, into their workplace pension, they too could be on target for a £100,000 pension pot.

“Getting into the savings habit early can make a huge difference to how much you can build up. The other important aspect is where you are investing your money. An initial £60 per month saved in a savings account or cash ISA returning 1% per annum would grow to only £52,000 over 40 years. On the other hand, those prepared to take more investment risk could see higher returns. Over 40 years, an initial £60 contribution per month, but with an investment return of 6% each year rather than 5% would produce a pot of £126,100, around £26k higher. If considering investment choices, we recommend seeking advice.”

|