Although the bulk annuity market demonstrated remarkable resilience in the face of Covid-19 during 2020, some schemes and sponsoring employees appear to have been affected. Some may have made less progress in their planning and preparations for a transaction, which would otherwise have hit the market in the early part of 2021. The relatively slow start to the year means a number of insurers may not have fully reached their goals from the beginning of the year, potentially increasing appetite as we come to the year’s end and head into 2022.

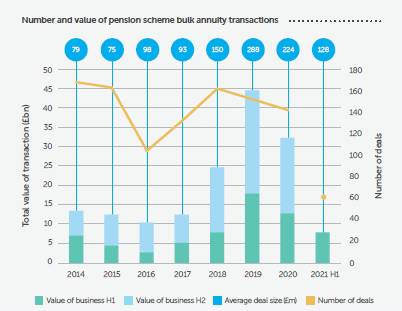

While the first half of 2021 only saw £7.7bn of buy-ins and buyouts, projected total market volumes for 2021 are still anticipated to be around £30bn. This would continue the step change in the level of market activity seen since 2018.

While this has not reached the heights of 2019, the year total will come close, if not exceed, £30bn – bringing it in line with 2020 volumes, which was the second busiest year on record despite the pandemic.

Further findings from the report

• While pensioner buy-in pricing has returned to more typical pre-pandemic margins above gilts, following the spike in credit spreads in Spring 2020, it continues to remain at an attractive level for schemes looking to de-risk

• Schemes with significant equity or growth asset exposure are likely to have seen funding levels increase substantially, with a material acceleration of their journey towards buyout for a number of these.

• A significant proportion of schemes are expected to reach buyout funding over the next ten years (for DB arrangements of FTSE350 companies projected to be order of 60%), with a potentially marked increase in market demand in the period 5-10 years out.

• Trustees and sponsors can put themselves into a stronger position to transact and ensure that the bulk annuity contract delivers against its objectives by looking further ahead to the ultimate endgame of pension scheme wind-up. This longer term perspective helps tailor transaction preparations and empowers scheme stakeholders to manage their residual risks.

Gavin Markham, Partner and Head of Bulk Annuity Consulting, said: “The pipeline of business for 2022 from schemes seeking to insure their liabilities already looks very healthy. Both the supply and demand sides of the market are likely to support a very busy marketplace going into the New Year.

“Although the economic outlook may, at first glance, appear more positive than at the beginning of 2021 the industry needs to remain vigilant. Uncertainty still remains around the future progression of Covid-19, continuing implications of the UK’s exit from the EU, as well as global macro challenges – all of which give the possibility for headwinds for pension schemes and the bulk annuity market.

“As we look at the medium to longer term, the high level of demand from pension schemes is only set to continue as they head towards their ultimate goal. Future demand will inevitably come from a significantly greater number of schemes in a position to fully secure their liabilities via buyout, as well as partial buy-ins for those schemes navigating the overall de-risking journey and strategy for delivering the endgame.

“There is no ‘one-size-fits-all’ approach as every scheme will have its own path to follow, but each will have to consider numerous possibilities, potential storms or opportunities along the way. In order to achieve the best transaction outcome in what is set to be an increasingly busy market in the years to come, schemes must be well-prepared. Transaction readiness and a thorough understanding of market dynamics are key to maximising insurer appetite.”

|