A rise in long-term gilt yields of around 0.2% led to a decrease in the value of liabilities, improving scheme funding levels.

However, aggregate scheme assets were also down over the month driven by schemes’ hedging strategies. XPS Pensions Group estimates that bulk annuity volumes to exceed £50bn for 2023.

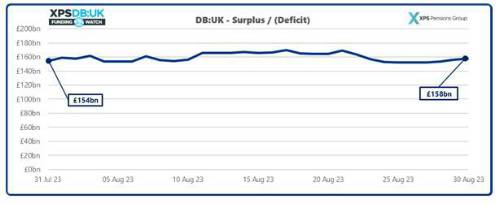

Overall, across August 2023, UK pension schemes’ funding positions have risen by c.£4bn against long-term funding targets. Based on assets of £1,421bn and liabilities of £1,263bn, the aggregate funding level of UK pension schemes on a long-term target basis was 113% as of 30 August 2023.

Stephen Purves, Head of XPS Pension Group Risk Settlement said: “With DB funding positions so strong, it’s no surprise that this year has seen record activity in the bulk annuity market. Around £21bn of new business has been written already, and it looks almost certain that 2023 will be the market’s busiest year on record, with deal volumes likely to reach £50bn for the year. That would surpass the previous record of £44bn from 2019.

Most of the insurers now have higher targets and increased capacity levels and as a result we are aware of a number of new entrants seriously looking to enter the market next year. XPS clients are still accessing good levels of engagement and pricing by having a clear strategy and undertaking detailed preparatory work at the right time.”

|