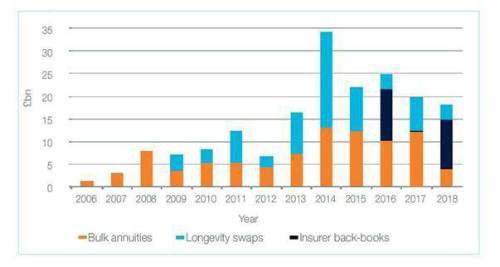

Rothesay Life’s £12bn acquisition of part of Prudential’s annuity book in Q1 marked a sea-change from the mid-size deals seen in 2017. Deals executed last year ranged from £100m - £900m, with no individual transaction exceeding £1bn. Current insurer pricing is providing an attractive entry point for schemes across the market, with improving funding levels and rising sponsor interest feeding trustee demand.

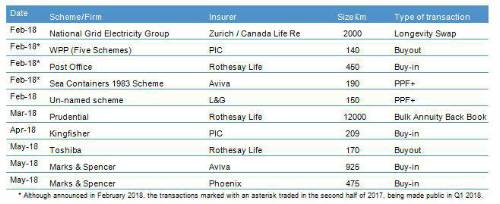

Beyond the Rothesay mega-deal and M&S’s £1.4bn buy-in with Aviva and Phoenix, several other potential £1bn plus transactions remain out at market and a £2bn longevity swap was transacted by National Grid Electricity Group. Despite the uptick in activity at the larger end of the market, the mid-sized segment continues to remain very busy, with a mix of Q1 2018 transactions and late-announced H2 2017 transactions, including the Post Office’s £450m buy-in with Rothesay Life, the buyout of five schemes by WPP with PIC, the Sea Containers £187m PPF+ buyout with Aviva, Kingfisher’s £209m buy-in with PIC, and Toshiba’s £170m buyout with Rothesay Life.

The market is moving away from historic practices used to obtain UK bulk annuity quotations. Demand for quotations in early 2018 is already so high that for those schemes that are still using traditional broking processes, insurers are pushing back delivery timescales significantly and being increasingly selective over which schemes they will quote for. Early evidence suggests that the recent move away from benefit specifications and separate scheme data files is bringing regular transaction-level pricing within the reach of all pension schemes.

Harry Harper, Head of Buyouts at JLT Employee Benefits, comments: “It’s encouraging to see new technology and innovation drastically shortening the process to obtain insurer prices from two months to, in some cases, as little as five days. This is something that has never been seen before in the bulk annuity market. At the same time the ease with which prices can be monitored over a period of time is enabling schemes to get quotations they might otherwise not have been able to get and to be on the front foot and transact rapidly when pricing hits a sweet spot. Looking ahead, innovation will continue to prove key to improving market efficiency.”

Publicised deals in 2018

Bulk annuity and longevity swap market volumes since 2006

|