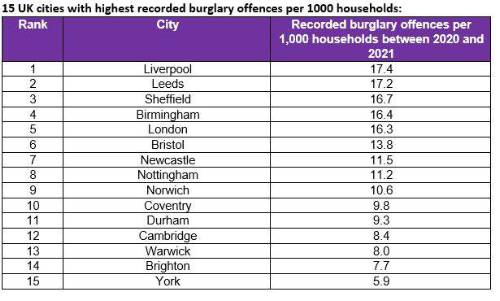

New research combining MoneySuperMarket home insurance enquiry data and UK Police Force data shows the university towns where burglaries are most prevalent and the areas where home insurance enquiries from students are low. Liverpool has the highest number of burglaries reported at 17.4 per every 1,000 households over the last year1. Leeds and Sheffield follow closely with 17.2 and 16.7 per 1,000 respectively.

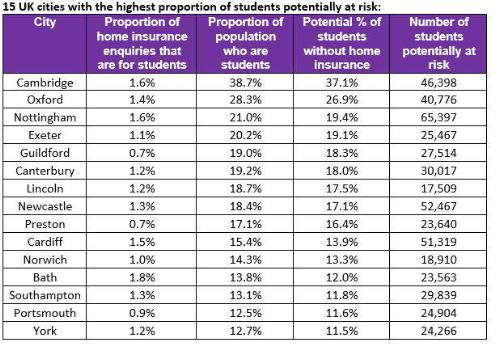

Nearly three-fifths of enquiries made by students include high-value items such as a bicycle or a laptop (58%) and one in five included an item worth over £1,000 (20%). Given the risk of burglary, it’s important that students protect these belongings, but figures suggest that a large proportion of the student population may be uninsured.

Only 1.6% of home insurance enquiries in Cambridge are made by students, which is far lower than the proportion of students in the population (38.7%) – a difference of 37.1%. Should 37.1% of the student population not be insured, this would equate to 46,398 students at risk.

Rival university city, Oxford, has the second highest proportion of potentially uninsured students (26.9%), with Nottingham coming third in the list (19.4%).

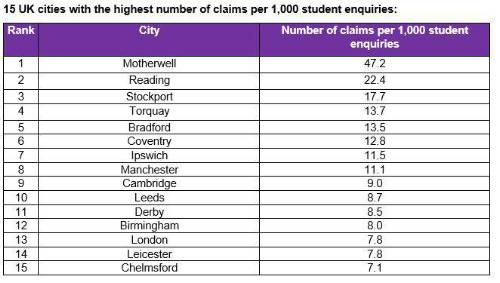

In terms of the cities where students are most likely to make a claim, Motherwell tops the table with 47 claims per 1,000 student enquiries. This is significantly higher than the second and third placed areas, Reading (22 per 1,000) and Stockport (18 per 1,000).

Despite having the highest number of burglaries according to police data, students from Liverpool are the least likely to have had a theft claim, which may suggest that students tend to live in areas of the city which are less at risk.

Kate Devine, home insurance expert at MoneySuperMarket, commented: “Home insurance might not always be a primary consideration for students, and the proportion of students making these enquiries is often far less than the total student population. This is despite the risks associated with living in student accommodation in busy, vibrant cities.

“With students also often owning expensive items like laptops, bikes and other gadgets, the cost of replacing these belongings can exceed £3,000. The impact of having to pay to replace items in the event of a burglary could be significant and taking out contents insurance – which costs far less in comparison – is a smart and inexpensive move to protect your possessions.

|