Buy-in and buy-out volumes in the first half of 2023 reached an all-time high, with the value of transactions secured being the second highest ever recorded for a six month period, says Hymans Robertson. The leading pensions and financial services consultancy has analysed results from all eight insurers* currently active in the market.

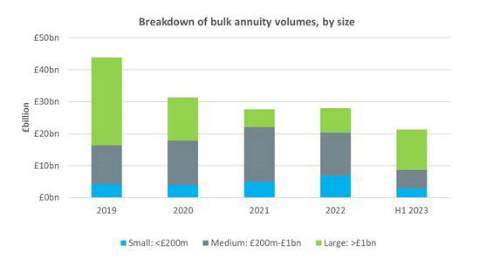

At a time when interest rates remain high, £21.3bn was secured over the first half of 2023 compared to £26.0bn being secured in the second half of 2019. Previously, the highest volumes for the first half of a calendar year were also secured in 2019 at £17.6bn.

In total £21.3bn of buy-ins and buy-outs took place across over 94 transactions during the first half of 2023 with an average transaction size of £227m.

Similar to 2019, large transactions dominated the market with 60% of bulk annuity volumes, i.e., £12.7bn, being in respect of 5 deals in excess of £1bn, including the record-breaking £6.5bn buy-in between the two defined benefit (DB) schemes sponsored by the RSA Group and PIC.

*Based on publicly disclosed transactions for Pensions Insurance Corporation.

Commenting on risk transfer volumes in H1 2023, James Mullins, Partner & Head of Risk Transfer, Hymans Robertson, said: The risk transfer market was incredibly busy in the first half of 2023. However, that was just the tip of the iceberg, with unprecedented demand from pension schemes meaning that the buy-in market is expected to smash all previous records over the next year and beyond. This means that pension schemes will need to embrace changes to the way they approach the insurance market and adopt a more targeted approach with scheme size being a driving factor.

“For many small schemes below £100m the focus will be on having an all-encompassing view of the market to confidently approach their chosen insurer on an exclusive basis. Medium-sized schemes, between £100m and £1bn, should make sure that their broking process, and requests of the insurers, are sufficiently straightforward to ensure they are a priority case. Large-sized schemes, over £1bn will typically have unique considerations that need to be addressed, so the focus will be on optimal timing for all stakeholders, defining clear objectives and requirements at the outset with detailed insurer engagement.

|