•New research shows pay and workplace pensions are often negatively impacted by changes to working patterns, with one third of women (32%) reducing their hours for an extended period of time during their working life

To help narrow the gender pension gap, longevity think tank Phoenix Insights is calling on government to make it a legal duty for employers to inform staff of the impact that any changes in their working hours (and resultant earnings) may have on their pension contributions.

This is based on its latest insight which shows there is a real need to help people better understand how working hours and earnings impact pension savings.

One third of women (32%)* reduce their hours for an extended period at points during their working lives for reasons that are explored in a new report ‘Caught in A Gap: the role of government in enabling women to build better pensions’ from Phoenix

Insights and IES.

The report is the second** of two reports which analyse women’s long-term finances through the lens of the workplace and looks at how the life events that women may encounter affect their working patterns, choices, and consequently their ability to save.

Based on the findings of the report, Phoenix Insights is making a number of calls to action for government to help close the gender pension gap.

Over half (55%)* of women would like to receive more information about their workplace pension from their employer, and more regular communication that goes beyond the mandatory minimum is seen as important to increase pension engagement, according to the research.

The new analysis finds government action to improve pension policy, support employers and introduce legislative protections that help keep women in employment across different life stages, will help to increase saving capacity and close the gender pension gap.

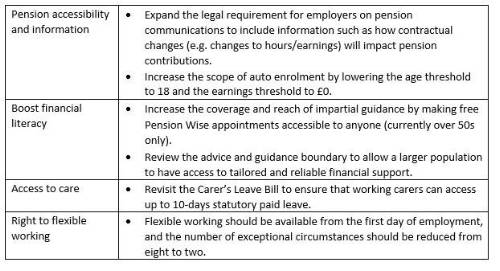

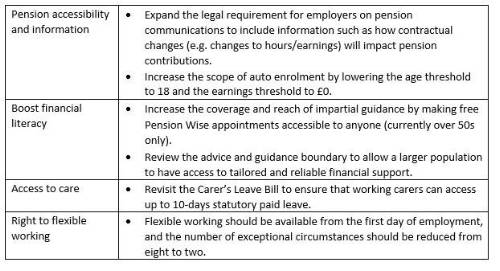

Key recommendations for the government to close the gender pension gap:

The recommendations are set against the backdrop of Phoenix Insights’ research* showing one in five women (20%) have opted out of a workplace pension scheme. Out of those that opted out, 36% of women did not consider the impact that opting out of their pension would have at the time of their retirement or the loss of benefits at retirement.

Catherine Foot, Director of Phoenix Insights, said: “Women are being left behind in their pay and pension saving at key life stages and decisive action is needed to reform current policies and practices to support businesses and individuals in addressing saving inequality. Alongside employers, our research with IES highlights the need for the government to increase their efforts to close the gender pension gap.

“Efforts should be focused on improving pension policy, providing better support for employers and introducing legislative protections for women at life events. We have identified key recommendations for these areas, including better pension accessibility and information, boosting financial literacy, and improving access to care and flexible working.

“Coordinated cross-departmental action to reform policy at the points which make the biggest impact to women’s working lives will lead to meaningful progress on the gender pension gap.”

Abbie Winton, Research Fellow at the Institute for Employment Studies, said: “If the current and future governments fail to act on the gender pension gap, we can be certain that increasing numbers of women will receive an income at retirement which will fail to allow them to meet their basic needs.

“Legislative changes, particularly around the removal of auto-enrolment thresholds, widening access to advice, improving the affordability and accessibility of child and social care, and rights to flexible working, are all critical to allow individuals to take control over both their working lives and their ability to save in a way that works for them.”

In response to this report, Phoenix Group, the UK’s largest long-term savings and retirement business, has made new commitments to:

• Proactively look to re-enrol employees not on the workplace pension scheme every year, instead of every three

• Make pension impact information compulsory when reducing working hours

• Monitor and analyse the monthly pension contributions of male and female colleagues across Phoenix Group

• Work with its workplace pension clients to devise a standard analysis and reporting methodology for measuring the Gender Pension Gap

|