The Broadstone Sirius Index – a monitor of how various pension scheme strategies are performing on their journeys to self-sufficiency – delivers its half-year update for H1 2023.

The half-year update of The Broadstone Sirius Index shows a pension scheme funding environment that looks strongly-placed for a bumper six months of buy-out activity as the insurance market readies itself for a “hectic half” following the turbulence in gilt markets in H2 2022.

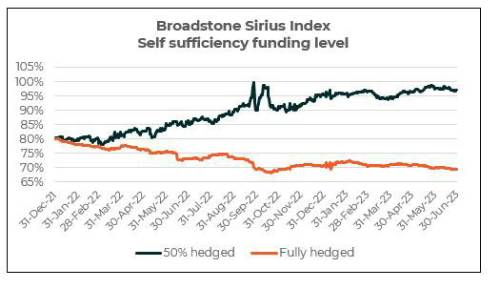

Through the first six months of 2023, the 50% hedged scheme tracked by Broadstone saw liabilities shrink (-5.1%) at a far faster rate than assets (-3.4%). The resulting improvement in its funding position of 1.7 percentage points over the period means that over the past eighteen months funding levels have risen from 80.0% to 97.1%.

Meanwhile, the fully hedged scheme saw less volatility through H1 2023 but asset falls (-6.8%) did slightly outpace liability falls (-5.1%), causing a funding level deterioration.

Chris Rice, Head of Trustee Services at Broadstone, noted "The second half of 2022 saw dramatic swings in gilt yields forcing the Bank of England into a dramatic intervention to quell the LDI crisis.

“In the aftermath, Trustees will have been glad to see calm return to markets in the first six months of 2023 and many will have been left in a significantly better funding position as a result. Our modelling shows that funds were someway off buy-out funding at the start of 2022 but could well be within striking distance if 2023 continues in the same vein.

“Insurers that have released their mid-year results have disclosed a significant increase in premiums and/or number of deals completed compared to last year and with rumours of ‘mega deals’ circulating, it all suggests we are looking at a hectic half and record year for transactions.

“Increased market congestion means it will become increasingly difficult for schemes to attract attention and receive as many competitive quotes as they’d like. While there are murmurings of new entrants in the market, there is significant work required for an insurer to start writing business, so this additional capacity is a way off.

“This means schemes wanting to buy-out need to be patient, well prepared and work flexibly with their brokers and insurers to get the best result.”

|