Tim Gosden, Head of Strategy for Legal & General’s individual annuity business Tim Gosden, Head of Strategy for Legal & General’s individual annuity business

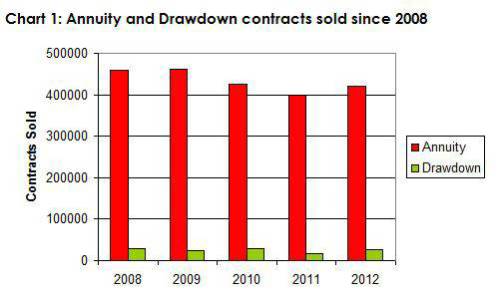

However, last year there was a smallish 5% improvement in the number of annuity contracts sold, so perhaps there are some early signs of a recovery. Pension funds also recovered in 2012 with annuity new business premium of just over £14bn being up 25% on 2011 and overall average pot size at £33,000 up by 20%. Unfortunately, the same can’t be said of income drawdown sales, which at £1.2bn were slightly down on 2011 and still down on 2008 both in terms of contracts sold and new business premium.

Are more consumers shopping around?

The tendency for a large proportion of consumers to buy their annuity from their pension company without shopping around for a better deal is a popular topic in the financial press. But it is all bad news?

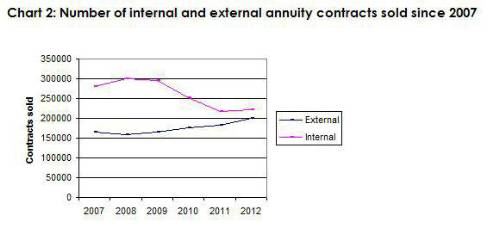

The second chart below compares the number of contracts sold internally, that is where consumers are purchasing their annuity from their existing provider, with those who purchased their annuity externally from another company - in over 85% of cases with the assistance of a financial adviser.

Source: ABI long term new business statistics 2013

Last year, just over half of all annuity contracts sold were purchased internally and the reasons why some of these consumers choose to stay put include a low awareness and a lack of understanding of the annuity options available to them, having a pension fund that is small and below the level where advice is accessible and in some instances a poor pre retirement process from their pension provider. All these factors can lead to a state of financial paralysis, which results in some of these customers taking the line of least resistance and rolling over into a potentially poor outcome. Another factor is that last year, 75% of internal pension pots were less than £30,000 and having a small pot is undoubtedly another influence that can affect a consumers appetite and ability to shop around.

However, on a more positive note, not all internal customers fall into this bracket. An internal annuity sale doesn’t necessarily mean the consumer didn't look around for a better deal, nor should it be automatically assumed that they got a poor outcome. Let’s not forget that many consumers have saved for their pension with companies who are also competitive annuity providers and in some cases offer a very good retirement journey to their customers. And as the chart below indicates there is an improving trend in the number of consumers shopping around and buying their annuity externally, which is good to see.

Source ABI long term new business statistics 2013

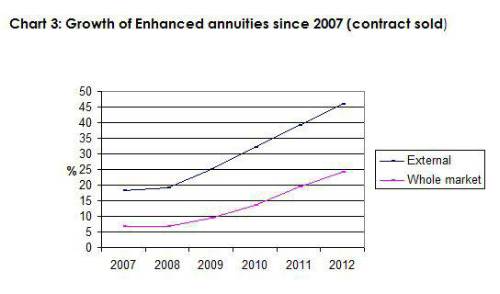

Improving understanding of Enhanced Annuities

To end this snapshot, mention must be made of the astonishing growth in sales of enhanced annuities. Last year, 46% of annuity contracts sold externally were enhanced annuities and as the third chart demonstrates, the growth in external sales has been dramatic, more than doubling since 2008. For many consumers the idea that their annuity income could be improved by virtue of them being in ill health is confusing and one that many struggle to understand. Particularly, as with most forms of insurance, the opposite is the case and they need to show that they are healthy to get better terms.

A key reason for this growth is that many of these customers seek help from a financial adviser who will emphasise the benefits of making a full disclosure and automatically check to see if they qualify for enhanced terms. Also, many people still associate enhanced annuities with severe illnesses, which used to be the case when these products first appeared in the mid nineties. Nowadays, as well as severe illnesses, customers may also qualify for an enhanced annuity based on lifestyle health risks such as high blood pressure, high cholesterol and extreme body mass, whether too high or too low. So qualification for enhanced terms is much wider than it used to be and as a result more financial advisers are asking all of their customers to complete a lifestyle/medical questionnaire, just to be sure they don't miss out on extra income.

In addition, falling annuity rates has focussed attention on squeezing out as much retirement income as possible from customers pension pots, making considering an enhanced annuity a ‘no brainer’

Unfortunately, the same isn’t true for internal sales of enhanced annuities, where in 2012 only 4% were sold on an enhanced basis. Given it is estimated that 50 - 60 % of consumers could qualify for an enhanced rate, then clearly a lot of these customers are missing out. Sadly, this is because many of these customers don’t shop around and also because there are still companies that simply don't offer an enhanced annuity product to their maturing pensions customers.

Source: ABI long term new business statistics 2013

So getting more consumers to shop around, improving their awareness of the retirement options open to them and helping them to make better choices concerning their retirement income are key objectives of the new ABI Code of Conduct on Retirement Choices that came into effect on 1st March 2013. Hopefully by the time our next retirement income snapshot comes around we will see some more positive changes in the shape of the retirement income market.

Tim’s Retirement Puzzle

Which area of the UK has the highest life expectancy at age 65 for 2004–06 to 2008–10 (based on ONS Statistics)?

a) Eastbourne

b) Kensington and Chelsea

c) Bridport

d) Lyme Regis

e) Chelmsford

f) Westminster

Highlight white text for answer: B) Kensington and Chelsea

|