Defined benefit (DB) pension plan sponsors in Canada have seen a marked increase in their solvency funding in the first quarter of 2013 thanks to a combination of company contributions, a strong equity market and a slight increase in interest rates, according to Aon Hewitt. The median pension solvency funded ratio – or the ratio of the market value of plan assets to liabilities — is approximately five percentage points higher at March 31, 2013 than at the start of the year.

According to Aon Hewitt, all of the major factors influencing pension plan solvency position were favourable this quarter. Interest rates, while remaining close to record low levels, reversed their seemingly constant decline from the last few years. This pushed down the value of liabilities of pension plans, improving funding. The discount rate used to calculate the liabilities to be settled by annuity purchases in case of a plan termination went up from 2.96 percent at the beginning of the year to 3.04 percent close to the end of the quarter.

Equities performed well, with US Equities leading the pack at 12.86 percent for the quarter, followed by International Equities (7.27 percent), Canadian Equities (3.34 percent) and Emerging Market Equities (0.38 percent). Pension plans invested in alternative asset classes such as Global Real Estate and Infrastructure were rewarded with returns of 8.42 percent and 9.27 percent respectively. Finally, most plan sponsors had to contribute towards their deficits due to minimum solvency funding requirements.

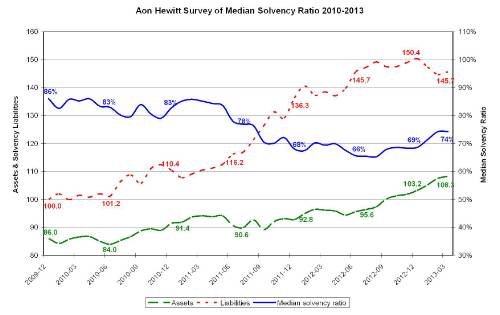

The combination of all these factors led to a rise in Aon Hewitt’s median solvency funded ratio of a large sample of pension plans from 69 percent at the end of 2012 to 74 percent at March 31, 2013. About 97 percent of pension plans in that sample had a solvency deficiency as at March 31, 2013. The solvency funded ratio measures the financial health of a defined benefit pension plan by comparing the amount of assets to total pension liabilities in the event of a plan termination.

“There are three main ways that plan sponsors will see themselves out of this solvency conundrum,” said Ian Struthers, partner, Investment Consulting Practice, Aon Hewitt Canada. “Through an increase in interest rates, favorable equity and alternative markets returns, and/or through higher employer contributions. We saw all three last quarter.”

The following graph depicts the movement of assets, liabilities and funded ratios for this median pension plan since January 1, 2010.

We can see that assets have only increased by 26 percent over the three-year and three month period since December 31, 2009 while liabilities, driven by a continuous drop in long-term interest rates, have increased by 46 percent over the same period.

Impact of de-risking

As well as the typical plan, Aon Hewitt has also tracked the performance of a plan that has employed a few simple de-risking strategies since January 1, 2011. Namely:

- Increased investment in bonds from 40 percent to 60 percent of the portfolio

- Investment in long bonds instead of universe bonds to better match liabilities.

The de-risked plan would have experienced an 82 percent solvency ratio as at March 31, 2013 as opposed to 74 percent for the median plan.

“There are many ways to de-risk a portfolio and it is especially important to have a strategy when there is uncertainty around market direction,” concluded Struthers.

|