Comprehensive car insurance premiums have increased sharply by 19% (£100) during the last 12 months, with UK motorists now paying £629 on average, according to the latest Confused.com Car Insurance Price Index in association with WTW (NASDAQ: WTW), a leading global advisory, broking and solutions company.

Car insurance premiums have now risen for five straight quarters since the last three months of 2021, and recorded a price rise of 7% (£43) in the final quarter of 2022, according to the longest established and most comprehensive car insurance price index in the UK. The index is based on price data compiled from over six million customer quotes per quarter.

Source: WTW / Confused.com Car Insurance Price Index. *Values rounded to the nearest whole number.

Tim Rourke, UK Head of P&C Pricing, Product, Claims and Underwriting at WTW, said: “The last 12 months have been characterised by persistently high inflation and insurers adjusting to the new FCA pricing rules while maintaining margins. With supply chain disruption, labour shortages, lack of raw materials and increasing food, fuel and energy prices set to continue, the upward pressure on premiums, primarily driven by claims inflation, is set to continue well into 2023.”

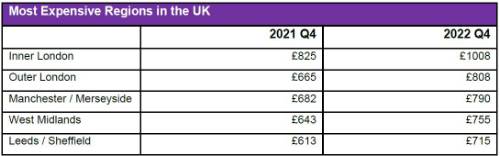

All regions across the UK recorded double-digit price rises in insurance premiums over the last 12 months. Drivers in Central Scotland and Inner London saw the largest percentage increase in the cost of comprehensive car insurance, where drivers saw an annual rise of 22% with average premiums now costing £547 and £1008 respectively. The smallest annual increase was seen in Manchester/Merseyside and the North West of England, where drivers still saw a significant annual rise of 16%, with average premiums now costing £790 and £599 respectively.

Manchester / Merseyside (£790) and the West Midlands (£755) remain the most expensive areas outside of the capital, while the South West continues to be the cheapest region for car insurance, where prices on average cost £417.

Source: WTW / Confused.com Car Insurance Price Index. *Values rounded to nearest whole number.

More locally focused data shows motorists in Kilmarnock in Central Scotland and the Outer London boroughs of Sutton and Enfield experienced the sharpest annual rises of 25% taking their average premiums to £483, £673 and £847 respectively. West Central London continues to be the most expensive postcode in the country where drivers now pay an average bill of £1233, while Llandrindod Wells in Wales remains the cheapest town in the UK with prices on average now costing £385.

Male drivers aged 71 and over saw the greatest percentage increase of 24% (£88) during the last 12 months, taking their premiums to £456. Following a 19% annual shift in prices (£277), male drivers aged between 17 and 20 now pay on average £1764, which is the most of any demographic and £449 higher than the next highest age group. Female drivers aged between 66 and 70 continue to benefit from the lowest annual premium at £309.

Tim Rourke said: “Rising interest rates, along with the prospect of falling inflation over 2023, will help insurers’ overall profitability. At the same time, the wider economic environment of falling household incomes, cost of living pressures and volatility in financial markets is expected to affect demand significantly across insurance lines, including motor insurance.

“Insurers will also now have to consider the impact of the recent Court of Appeal ruling on mixed injury claims that seems likely to put further upward pressure on premiums.”

Louise O’Shea, CEO at Confused.com comments: "The news around the latest price increases isn’t what we want to be sharing with consumers in the current financial climate. Following the FCA pricing changes 12 months ago, we expected prices to increase, but perhaps not quite at this rate.

"Despite renewal pricing regulations, it's clear that insurers should be doing more to help consumers during difficult times. Auto-renewal isn't getting any easier to navigate. In many cases, and for too long, insurers have designed journeys to keep consumers locked in to existing policies, frustrating their desire to shop and switch. With this in mind, the FCA's introduction of its new Consumer Duty, which sets higher and clearer standards of consumer protection across financial services, will require firms to put their customers' needs first. This should make it as easy for consumers to cancel their insurance policy as much as it is to buy it."

“With rising costs all around us and a real worry for millions right now, consumers need to be savvy with spending. Fortunately, the cost of car insurance is an area where savings can be made. Renewal prices won’t always be the best price out there, but the good news is that there are still lots of ways to save money.”

|