Following a two-year-long upward trajectory in prices, car insurance premiums have now decreased for two consecutive quarters following an initial price fall of 5% (£54) in the first three months of 2024.

However, car insurance premiums still recorded an annual rise of 14% (£106), according to the longest established and most comprehensive car insurance price index in the UK. The index is based on price data compiled from over six million customer quotes per quarter.

Source: WTW / Confused.com Car Insurance Price Index. *Average values rounded to the nearest whole number.

Tim Rourke, UK Head of P&C Pricing, Product, Claims and Underwriting at WTW, said: “After a sustained period of significant rate increases to counter the high levels of claims inflation, it is interesting to see from this data a change in insurers’ behaviour indicating that premium adequacy may now be sufficient to allow insurers to drop rates. However, insurers still face a number of ongoing challenges, including the rising cost of materials and labour, second hand cars and advanced vehicle technology, as well as operating in a changing political landscape.”

All regions across the UK recorded price falls over the last three months. Drivers in the North West saw the largest percentage decrease in the cost of comprehensive car insurance, with a quarterly fall of 8% with average premiums now costing £819. The smallest annual decrease was seen in Northern Ireland, where drivers saw a quarterly cut of 4%, with average premiums now costing £925.

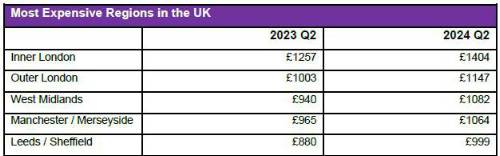

The South West of England continues to be the cheapest region for car insurance, with average premiums seeing a quarterly drop from £606 to £571 (6%). Even though car insurance premiums in Inner London fell by £97 (7%) in the last three months, this still remains the most expensive region with average prices at £1404.

The West Midlands region remains the most expensive area outside of the capital, with average premiums falling by 7% (£75) in the last three months and now costing £1082, followed by Manchester / Merseyside (£1064).

Source: WTW / Confused.com Car Insurance Price Index. *Average values rounded to nearest whole number.

More locally focused data shows motorists in Perth experienced the greatest quarterly fall of 9% taking their average premiums from £644 to £585. West Central London continues to be the most expensive postcode area in the country where drivers now pay an average bill of £1735, while Llandrindod Wells in Wales remains the cheapest town in the UK with prices on average now costing £525.

Drivers aged 20 benefited from the greatest price fall, compared to other age groups, seeing a 9% (£227) quarterly price decrease, however they are still bearing the brunt of some of the most expensive prices with average annual premiums now at £2259. The age group to see their car insurance prices decrease by the smallest margin during the second quarter of 2024 were drivers aged 71 and over, with a drop of just 3% (£15) and an average annual premium of £584.

Steve Dukes, CEO at Confused.com comments, “It seems after a long period of such steep increases in car insurance prices, the industry is starting to stabilise, adjust to increased claims costs and bring prices down.

“However, prices are still up year on year, creating opportunities for insurers to grow their customer base and for consumers to save by switching. We're finding insurers using industry insights and data are able to compete more effectively

|