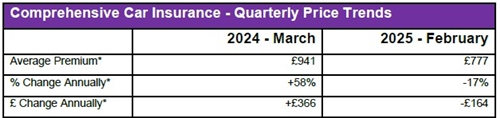

Comprehensive car insurance premiums have fallen by 17% (£164) during the last 12 months, with UK motorists now paying £777 on average, according to the latest Confused.com Car Insurance Price Index in association with WTW (NASDAQ: WTW), a leading global advisory, broking and solutions company. This is the biggest annual percentage decrease since 2014 and follows a downward trajectory in prices that began in the first quarter of 2024, according to the longest established and most comprehensive car insurance price index in the UK.

Source: WTW / Confused.com Car Insurance Price Index. *Average values rounded to the nearest whole number.

Tim Rourke, UK Head of P&C Pricing, Product, Claims and Underwriting at WTW, said: “With claims frequency continuing at the lower levels seen last year into the first quarter of 2025, combined with reduced damage average costs, insurers have been able to adjust their prices and pass savings on to customers. Improved stability in average used car prices during the last 12 months is another key contributing factor, having previously been a significant driver of premium increases between 2020 and 2023.

“The outlook on pricing for the year ahead, however, remains ambiguous given the as yet uncertain impacts of recent legislation coupled with the steady rise in the uptake of electric vehicles and associated higher claims costs, which will continue to put pressure on insurers as they battle to keep pace with new technology and the wider claims environment.”

All regions across the UK recorded price falls over the last 12 months. Drivers in Inner London saw the largest percentage decrease in the cost of comprehensive car insurance, with an annual decrease of 20%. The region does, however, remain the most expensive in the UK with average premiums now costing £1,208. The smallest annual decrease was seen in South West England, where drivers saw an annual fall of 12%, with average premiums now at £532. South West England has also been replaced as the cheapest region for car insurance by Central and North Wales, where average premiums now cost £523. The West Midlands remains the most expensive area outside of the capital, with average premiums now costing £943.

Source: WTW / Confused.com Car Insurance Price Index. *Average values rounded to nearest whole number.

More locally focused data shows motorists in South West London benefited from the biggest drop in car insurance premiums, where prices fell by 21%, from £1,351 to £1,0612. Despite a similar drop in average premiums, West Central London continues to be the most expensive postcode in the country, with average prices now costing £1,430. Llandrindod Wells in Wales remains the cheapest town in the UK with prices on average now costing £455, making it the only town in the country where average premiums are less than £500.

Drivers aged 17 and 18 benefited from the greatest price fall, compared to other age groups, seeing a 23% annual price decrease, reducing their premiums to £2,258 and £2,434 respectively. The age group to see the most marginal annual decrease to their car insurance prices were drivers aged 50, with a fall of 11% (£83) and an average annual premium of

£655.

Steve Dukes, CEO at Confused.com said: “Car insurance prices have dropped for drivers across all age ranges and in the majority of UK areas. But the biggest drops have been felt by younger drivers, who are seeing some very significant savings compared to this time last year. Behind the general trend of falling prices, we see a more complex picture as insurers increasingly compete for specific customer segments, using investments in data and technology to inform their pricing strategies. Consumers continue to shop around, creating opportunities for focused insurers to grow their customer base.”

|