|

|

The AA's latest British Insurance Premium Index shows that quotes for car insurance jumped by 5.8% over the last quarter of 2016 |

Car premiums jump £35 over three months

AA Insurance Index shows steady two-year premium rises

Premiums up 11.7% over year – five times more than train fares Injury, accident damage, IPT, uninsured cars drive costs up

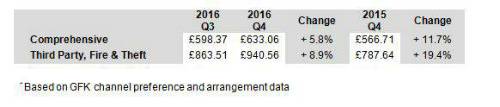

The average Shoparound quoted premium for a typical policy increased by nearly £35 to £633.06 over the three months ending 31st December, and by more than £66 (11.7%) over the year.

The latest increase has taken the average quoted premium to a four-year high.

AA BIPI - Motor Insurance Shoparound Movements All channels*

Several factors are influencing car insurance premiums, according to Michael Lloyd, the AA’s director of insurance. “Uninsured driving is rising; partly I believe because of the increases in Insurance Premium Tax (which will rise by another 2% in June)(2), and fraud – particularly whiplash claims – continue to dog the industry.

David Brown, Insurance Partner at KPMG UK, says: “The cost of accidental damage is rising fast – and I believe it’s becoming a much bigger threat to motor policy price inflation than whiplash.

“As of a year ago, insurers were seeing 20% rises in the cost of average repairs for damage to their policyholders’ cars.

“I expect that when new figures come out over the next few months, there may be more bad news with costlier accidental damage repairs which may well lead to premiums suffering further upward hikes.”

The AA says that accidental damage claims inflation is currently adding around £25 per year to the average quoted price.

On personal injury claims, Lloyd adds: “The number of personal injury claims has started to show signs of slowing and the Ministry of Justice has embarked on fresh reforms to curb cold-call culture which contributes to Britain’s unwelcome status as ‘whiplash capital of Europe’.

“Recent research of drivers by the AA(3) showed that 63% were contacted by a claims management company in the last 12 months about personal injury claims, over a third (34%) more than ten times.

“Almost all (95%) regard these calls as a nuisance.

“What’s more, claiming for an injury even if none was suffered is so embedded in British culture that 44% of respondents agreed that making a claim for injury has become ‘an easy way to make money’ although 85% consider doing so to be ‘morally wrong’.”

Detected insurance fraud costs the insurance industry £1.3bn.(4) And, while the number of road traffic collisions has fallen by 39% over the past 15 years, the number of injury claims – largely whiplash – has risen by 90% and adds around £40 to the average car insurance premium.(5)

“Insurance is based on claims experience. It’s also extremely competitive and I have little doubt that if the number and cost of claims falls, then the cost of an annual insurance policy will also fall.”

The Index also shows that quoted premiums for young drivers rose by slightly less than the average but those aged between 17-22 nevertheless pay by far the highest cost for their cover.

“Paying an average of over £1,400 for a year’s cover, compared with £380 for those in their sixties, young drivers have been particularly hard hit by the rise in IPT which, by June, will have doubled in less than two years.

“I believe that this is fuelling the rise in uninsured driving. This isn’t a victimless crime because compensation for injury and damage to third parties, caused by uninsured drivers, is ultimately paid for by insurers to the tune of around £35 per policy.

“We join the British Insurance Brokers’ Association in calling on the government cut IPT from the premiums paid by young drivers for the first two years of their cover – which will help with the affordability of cover as they build up a no-claim bonus as well as ensure that they start driving legally.”

Car insurance winners and losers

Regional data

All regions saw premium increases with the exception of Northern Ireland where the average quoted Shoparound premium fell by 3.0%. This makes the region the third most expensive region to insure a car. The biggest climber was London, where quoted premiums rose 8.6% to just over £800, making London the second costliest region to insure a car, after the North West (Granada) where the average quoted premium is £887.35. Scotland remains the cheapest region to insure a car which, after an increase of 5.5% has an average quoted premium of £458.75

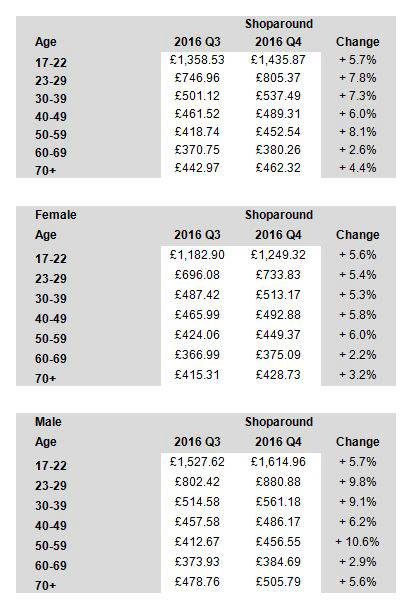

Premiums by age and gender

Although male and female drivers can expect to be quoted the same premium if all other elements of the quote are identical (car, mileage, occupation, address, driving record); men nevertheless can expect on average to be quoted a higher Shoparound premium than women. According to this data, young men can expect to pay more than £365 more than young women. Drivers aged 17-22 pay the highest premiums and they suffered an average increase of 5.7% to nearly £1,436 for a typical comprehensive policy. Those aged 50-59 saw their premiums rise by 8.1% to £452.54; while a driver aged between 60 and 69 can expect to be quoted the least for their cover, and suffered the smallest average premium increase – just 2.6%, to £462.32.  hoparound hoparound

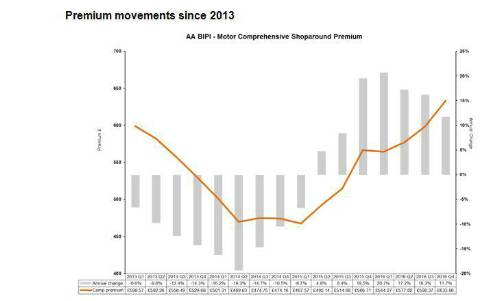

Premium movements since 2013

|

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.