-

Largest quarterly premium leap since 2010, thanks to IPT

-

Fraud ‘continues to haunt industry’

-

Young drivers see smallest percentage premium increase

-

Northern Ireland sees largest percentage premium increase

Over the three months ending 31 December, the average quoted ‘Shoparound’ premium* rose by over 10%, the largest such increase since 2010. Although premiums are rising, the increase in Insurance Premium Tax (IPT) has piled on the misery for motorists who have seen the typical cost of their cover rise by 20% over the past year.

According to the AA’s ‘Shoparound’ figures, an average of the five cheapest quotes in a nationwide basket of ‘customers’, the average premium for comprehensive cover rose from £566.56 to £625.70, up 10.4% over the last three months. Over the year, premiums rose by 20.3%.

The new figures coincide with publication of both the industry-wide Insurance Fraud Taskforce (IFT) report and the British Insurance Brokers’ Association (BIBA) Manifesto (on 18 January 2016).**

Both highlight the considerable cost to all policyholders – estimated *** to be around £50 per policy – of those who steal from insurers by making false of exaggerated claims.

Michael Lloyd, director of AA Insurance, says that personal injury claims – particularly whiplash injuries – continue to haunt the industry. “The UK suffers the unenviable reputation for being the ‘whiplash capital of Europe’ with the number of claims continuing to pile in, encouraged by vigorous cold-calling claims firms.

“New legislation proposed by the Chancellor in his Autumn statement and again in January, designed to curb claims activities and weed out spurious and fraudulent injury claims, is some months away from becoming law but are widely welcomed by insurers.

“Meanwhile, the IFT, to which the AA contributed, has proposed a range of additional measures to help tackle fraud ranging from organised crime to opportunistic attempts to rip off insurers, which has been welcomed by the Government.”

Research by AA Insurance last year suggested that 11% of respondents to a poll of over 20,000 drivers thought it was acceptable to make an insurance claim for injury following a collision, even if no injury was suffered.

“It’s this acceptance that it’s OK to defraud insurers that has become endemic. It is stealing and it affects the premiums paid by your friends, your family and your colleagues – those that most wouldn’t dream of defrauding.”

However, Mr Lloyd points out that the imposition of Insurance Premium Tax, which took effect from 1st November 2015, has been responsible for most of the premium increase recorded this quarter, pointing out that the average increase would otherwise have been below 7%..

“We expect premiums to continue to rise though 2016 but not at the exceptional rate recorded over the last quarter of 2015. And the sooner new legislation to tackle whiplash claims becomes enshrined in law, the sooner that will be reflected in the premiums quoted for car insurance.”

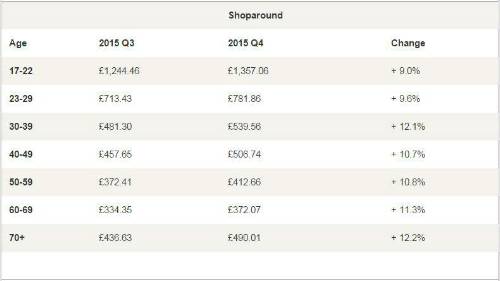

Winners and losers by age

The youngest drivers (age 17-22) – who nevertheless pay by far the highest premiums for their car cover – have seen the smallest increase over the quarter, of 9%, from £1,244 to £1,357. Those aged 70 and over suffered the biggest increase, typically 12%[NE2] , rising from £437 to £490.

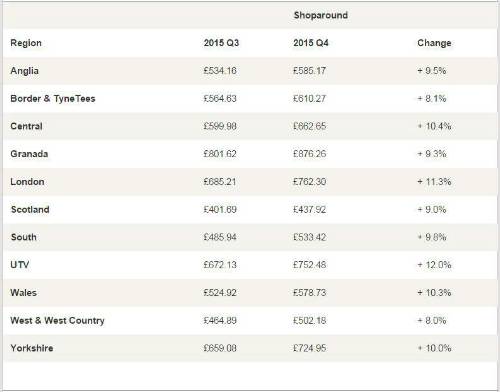

Winners and losers – by region

This quarter, average Shoparound quoted premiums for drivers in the North East rose by 8% or about £45.64 [NE3] - the smallest increase nationally, with an increase to £610. The biggest increase was in Northern Ireland where premiums saw the largest increase in average quoted premium (12%) to £752. However, the most costly region to insure a car remains the North West of England which saw a rise of 9.3% to an average quoted premium of £876. Scotland remains the cheapest place to insure a car with an average quoted premium of £437, having risen by 9% over the fourth quarter

|