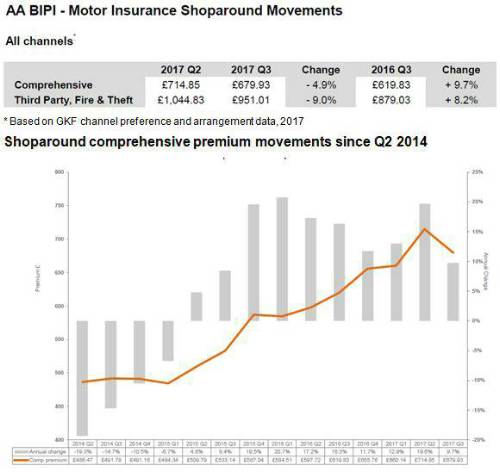

The Index Shoparound (1) quote which is an average of the five cheapest premiums quoted in a nationwide sample of buyers, fell from £714.85, the highest since the Index began in 1994, to £679.93 over the quarter ending 30th September.

But there is some way still to go if premiums are to return to 2014 levels and they are still £60, or 9.7%, higher than this time last year.

“This is certainly a small step in the right direction,” says Mike Lloyd, the AA’s director of insurance.

“Drivers have had to put up with some sharp premium increases over the past three years, in part thanks to avoidable Government interventions.”

This dramatic change in fortunes is attributed to a combination of factors, in particular the review by the government of the so-called ‘discount rate’ change announced in February 2017(2), which applies to the payment of injury claims. Insurers, the NHS and others were suddenly faced with losses of £millions thanks to a Government decision to slash the rate, leading to much bigger compensation payouts and, in turn, a sharp rise in car insurance premiums.

Explains Lloyd: “Ministers quickly got the message that their drop in the discount rate was too much, too far and was hitting drivers in the pocket.

“I’m glad that they announced in September that they would review it and the industry has responded favourably.”

Lloyd also believes that the industry is responding to the proposed Ministry of Justice reforms to the dysfunctional whiplash claims industry which encourages people to claim for injuries that may never have happened.

“Although the reforms(3) are not expected to be introduced for another year, the government claims they will have the potential to knock 30% off the typical car insurance premium paid. The reduction we have revealed today underlines the industry’s willingness to pass cost savings straight on to their customers.

“But it is important that the much-delayed reforms are at last pushed through.”

However, Lloyd says he is concerned that the Chancellor doesn’t see the latest premium reductions as an excuse to pile more on to Insurance Premium Tax.

“The message I send to the Chancellor is that drivers who have no choice but to pay for car insurance – or drive illegally – have suffered enough with rising costs and to leave IPT well alone in his November Budget.

“This is a stealth tax that doubled in two years. It’s clear that rising costs have driven many young drivers to attempt to drive without insurance. There has been a big jump in the number of uninsured drivers, evidenced by the rise in the number of collisions involving those without cover as well as ‘hit and run’ incidents, that are likely to involve illegal drivers.

“I strongly urge the Chancellor to consider removing IPT completely for young drivers who use telematics or ‘black box’ insurance which is proven to contribute to road safety.

“Such a positive step will encourage young drivers to get behind the wheel both safely and responsibly and, in turn, help to reduce car insurance premiums for everyone by cutting claims costs.”

• Biggest quarterly drop in cover cost since 2014

• Premiums fall 5% from highest ever level

• Industry responds to discount rate and whiplash reforms

• But falls not an excuse to hike IPT, AA warns

|