Car insurance premiums have now seen consecutive annual increases for the last two quarters, following the implementation of the new FCA pricing rules on 1 January 2022. Motor insurance premiums have now also risen for three quarters in a row, with a marginal rise of 1% (£4) recorded in the last three months, according to the longest established and most comprehensive car insurance price index in the UK. The index is based on price data compiled from over six million customer quotes per quarter.

Tim Rourke, UK Head of P&C Pricing, Product, Claims and Underwriting at WTW, said: “A combination of rising accident frequency after the pandemic lull and surging inflation sees upwards pressure on insurance prices coming from claims costs and repairs. These challenges are compounded by insurers also having to respond to the FCA’s pricing reforms, effective from January, which bans renewal prices being higher for existing customers than for new business.”

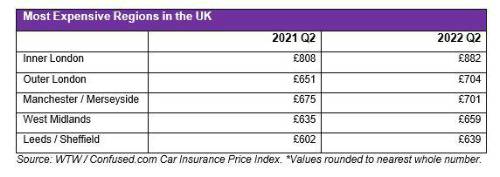

From April to June 2022, the cost of comprehensive car insurance increased the most in Outer London, where drivers saw a quarterly rise of 3% (£17), with average premiums now costing £704. Drivers in the South of England benefited from the greatest quarterly drop in prices, with their insurance premiums decreasing on average by 1% to £437.

Inner London remains the most expensive region, where prices are now on average £882 having increased in the last quarter by 2% (£18). Manchester and Merseyside (£701) continues to be the most expensive area outside of the capital, and only marginally less expensive than average premium prices in Outer London (£704). The Scottish Borders retains its position as the cheapest region for car insurance, where prices average £366, closely followed by the South West of England (£373).

More locally focused data shows motorists in Enfield, Motherwell and Lancaster experienced the sharpest quarterly rise of 4% taking their average premiums to £730, £490 and £425 respectively.

West Central London (£1,046) continues to be the most expensive postcode in the country and the only one where premiums on average exceed £1,000. Meanwhile, Llandrindod Wells in Wales remains the cheapest town in the UK, with drivers paying an average bill of £339 in the second quarter of 2022 for comprehensive car insurance.

Female drivers aged between 17 and 20 saw the greatest quarterly increase of just over 3% (£32), taking their premiums to £1,076, followed by male drivers aged 71 and over, who are now paying on average £404 after a 3% shift in prices (£11) in the second quarter of 2022. Male drivers aged between 17 and 20 are still paying the most of any demographic, now paying on average £1,511, while female drivers aged between 66 and 70 benefit from the lowest annual premium at £273.

Tim Rourke said: “Motor insurance prices have yet to skyrocket, despite the cost pressures, and remain fairly low by historical standards. Looking ahead, the picture is more mixed with the industry facing a raft of challenges over the second half of 2022 and into 2023. With premium rates well below the level needed to keep up with inflation, which is surging at its fastest pace in 40 years, insurers are bracing themselves for rising costs, such as more expensive repairs due to increasingly sophisticated vehicles, and ongoing supply chain issues forcing longer repair times.”

Louise O’Shea, CEO at Confused.com comments: “While they may not be the most expensive prices on record, we are now seeing some of the highest car insurance premiums in close to two years. This was to be expected, after a period of extremely low prices during COVID-19. However, with the current economic situation being faced by both businesses and consumers, I have no doubt we have another turbulent period ahead of us.

“There is an opportunity now for insurers to be as competitive as possible with their pricing, as consumers look to make savings wherever possible. And it’s important that as an industry we are helping our customers to find these savings.”

|