A police ‘spy from the cab’ campaign using unmarked heavy goods vehicles (1) to target drivers making calls or texting from handheld phones could lead not just to fines but big increases in car insurance premiums for offenders.

Some insurers could even decline to renew cover for those who are caught.

Trials with unmarked police lorries caught hundreds of car and truck drivers texting, phoning or committing other offences while they were driving – offences that might not have been spotted by officers in a car.

The high viewpoint from a lorry cab allows officers to gather evidence using a video camera. They then radio to a supporting officer on a motorcycle or in a car to pull the errant driver over.

Pointing out that insurance companies take mobile phone offences extremely seriously, Janet Connor, managing director of AA Insurance, says that she welcomes this initiative because of its potential to save lives.

“Drivers using a handheld mobile phone are at four times greater risk of having a crash. And although a CU80 offence for using a hand-held mobile phone commands only the same fixed penalty as an SP30 speeding offence (three points and a £100 fine), it could add another £100 to your annual premium as well.

“While drivers may mistakenly exceed a speed limit, no-one uses a handheld phone by mistake. It’s a deliberate act that diverts attention from driving, significantly heightening the risk of a crash.

“Depending on the circumstances the offence could be escalated to careless or even dangerous driving, which risks disqualification as well as a heavy fine.”

A few insurance companies may overlook a first speeding offence and most also overlook those who opt to take a speed awareness course instead of a fine and licence endorsement. But AA believes that the majority, if not all, insurers will penalise those who commit a mobile phone offence or collect a second speeding ticket, possibly not renewing cover when it comes up for renewal.

Ms Connor adds: “Those who flout the law are more likely to make a claim and their premium reflects that risk.

“Why should the majority of motorists who stay within the law, subsidise those who don’t?

“Those who have a single speeding conviction are up to 30% more likely to make an accident claim than those who have a clean licence. Someone who has two speeding offences is up to 60% more likely to be involved in a collision. A driver caught for crossing a red traffic signal is around 40% more likely to make a claim.(2) But it’s estimated that someone committing a mobile phone offence is four times more likely to be involved in a crash (3).”

Last year, AA-Populus research revealed that 23% of over 19,000 AA members admitted that they had: ‘been distracted, had a near miss or a crash in the past 12 months’ while using or interacting in some way with mobile phone or other mobile device. (4) In separate polls, 17% said they thought mobile phones were the biggest road safety issue facing road users while 31% said that using a mobile phone was the ‘most irritating behaviour of other drivers’.

“These are shocking admissions that underline the widespread use of and danger posed by phones. If a driver is texting, or calling with a handheld phone, they aren’t concentrating. Trying to steer and change gears with one hand and eyes on the device, not on the road, is a disaster in the making.

“No call or text can be more important than that.”

“Drivers also even admit that hands-free phones can be a distraction (4) and, in the event of a crash, police can take their use into account.”

Ms Connor also urges that those making a call to someone who is clearly answering while driving should ring off immediately. “It could save someone’s life,” she points out.

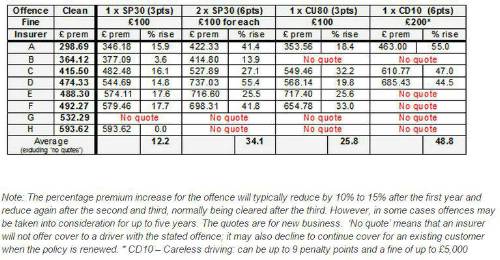

The effect of traffic offences on car insurance premiums

AA Insurance conducted research among eight insurers offering the cheapest quotes for a 35-year-old man driving a Ford Mondeo assuming a clean licence; and compared with premiums following motoring offence(s). Note that the CU80 mobile phone offence is sometimes escalated to CD10 (careless driving).

AA Advice on mobile phone use

1. Using a phone in a car

2. Don't use a mobile phone held in the hand while driving or while stopped with the engine switched on – it is illegal.

3. Stop and switch off the engine to make or take a call or text message, or leave it to go to voicemail – even if you have a hands-free phone.

4. If you must talk and are using a hands-free phone, keep conversations short and simple or say that you will find a safe and legal place to stop and phone back.

5. ‘Are you driving?’

6. ‘Are you hands-free? Is it safe to talk?’

7. Calling someone's mobile

8. If you call someone and think that they might be driving, ask them:

9. If the person taking the call is obviously driving and trying to continue the conversation it’s OK to say:

10. ‘I’ll call you back later’ or: ‘Call me when you have stopped’ and ring off

|