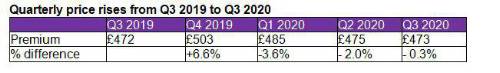

The cost of an average fully comprehensive car insurancepremium in the UK is currently £473 – down 6% from £503 at the end of Q4 2019. However, a modest quarter to quarter price drop of 0.3% between Q2 and Q3 suggests that the fall may be starting to taper off.

The fall of prices over the course of the year to date is thought to be linked to the coronavirus lock down and fewer cars being on the road, with research that road traffic levels dropped by 73% at the height of lockdown2.?

Despite prices falling in 2020, year on year comparisons show a slight increase with average premium prices rising from £472 to £473.

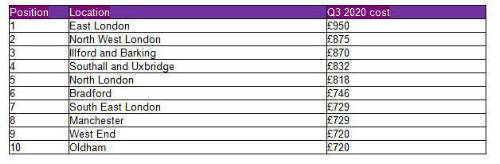

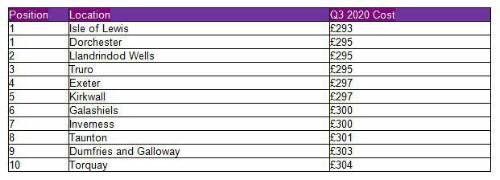

Drivers living in East London pay most for premiums (£950), more than double the UK average (£473), while London as a whole paid an average premium of £679. Licence holders on the Isle of Lewis have the cheapest premiums in the country (£293).

Top ten most expensive locations for car insurance premiums

The ten cheapest locations for car insurance premiums

Looking at age, premiums have fallen the most year on year for drivers aged between 17 and 19: the average price is down by 21% in the past 12 months with fully comprehensive cover now costing an average of £823 – down from £1037. However, premiums for this age-group did see a quarterly price increase of £46 from £777 to £823.

Drivers aged between 40 and 49 have seen the biggest price rise, with premiums up 5% year-on-year to £422, from £402.

The 20-24 demographic pays the most on average, with Q3 premiums costing £917. This compares to drivers aged 65 or more who pay the least - an average of just £281 a year.

Dave Merrick, car insurance spokesperson for MoneySuperMarket, commented: “Our research shows that prices continued to fall over Q3 but not at the same rate as the previous quarters this year.”

“This might be explained by the easing of lockdown measures and the ensuing increase in traffic on the roads – something which could factor into the pricing decisions of insurers. Time will tell whether the new lockdown restrictions being introduced across parts of the UK have a knock-on effect on prices.”

“Whether prices will creep back up again or not, it’s difficult to say, but if your policy is up for renewal, the best way to make sure you’re getting the right policy for your needs, and at the right price, is to shop around for a better deal– doing so can save you up to £2853.”

|