The average price paid for comprehensive car insurance continued its upward trend, after soaring by a record 58% (£338) during the last 12 months. UK motorists are now paying £924 on average as insurers battle sustained cost pressures, according to the latest Confused.com Car Insurance Price Index in association with WTW (NASDAQ: WTW), a leading global advisory, broking and solutions company.

Car insurance premiums are at their highest ever recorded levels since the WTW/Confused.com Car Insurance Price Index was launched in 2006. The previous peak was in the second quarter of 2023 when the average premium was £776. At 58%, the annual rise in motor insurance costs continues to far outstrip CPI inflation, at 6.3% in August.

Car insurance costs have now increased for eight straight quarters following a price rise of 19% (£148) in the third quarter of 2023, according to the UK’s longest established and most comprehensive car insurance price index. Based on price data compiled from over six million customer quotes per quarter, this is the largest quarterly increase on record. The previous fastest rise having also been set in the second quarter of 2023 (18%).

Tim Rourke, UK Head of P&C Pricing, Product, Claims and Underwriting at WTW, said: “Drivers are seeing their car insurance premiums soar by as much as 90 per cent as insurers battle a dramatic increase in claims costs, pushed higher by rising repair costs and labour shortages. As poor economic conditions bite, we are seeing claims in vehicle theft increasing alongside a rise in fraudulent claims also to blame.”

Source: WTW / Confused.com Car Insurance Price Index. *Values rounded to the nearest whole number.

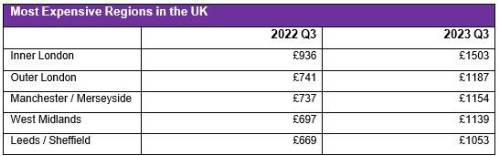

All regions across the UK recorded soaring double-digit price rises in insurance premiums over the last 12 months. Increases ranged from 50% for drivers in Central and North Wales, taking their annual premiums to £613, to the largest annual percentage increase of 63% recorded in the West Midlands, where those buying new policies found their premiums costing £1139, exceeding the £1000 mark for the first time.

Manchester / Merseyside remains the most expensive area outside of the capital, where the average policy is now £1154, following a £417 (57%) annual increase. The South West of England continues to be the cheapest region for car insurance, with average premiums now costing £597. Inner London is still the most expensive region, with drivers now paying an average bill of £1503, which is an annual percentage increase of 61% (£567).

Source: WTW / Confused.com Car Insurance Price Index. *Values rounded to nearest whole number.

More locally focused data shows motorists in Birmingham, Wolverhampton and Motherwell experienced the sharpest annual rise of 65%, taking their average premiums to £1275,

£1137 and £833 respectively.

West Central London continues to be the most expensive postcode in the country where drivers now pay an average bill of £1928. Llandrindod Wells in Wales remains the cheapest town in the UK, with drivers paying an average bill of £548 in the third quarter of 2023 for comprehensive car insurance.

Drivers aged 17-20 took the largest hit of any age group, with those aged 18 seeing the sharpest annual rise as prices jumped by £1414 (89%) compared to a year ago and now on average paying £2995.

Despite the record-breaking hikes in car insurance premiums seen in 2023, a more granular breakdown of the latest data from the WTW/Confused.com Index reveals a slowdown in the premium increases through the third quarter, with monthly increases for July, August and September at 7.5%, 6.6% and 4.1% respectively.

Tim Rourke said: “The latest monthly data suggests that the cycle of this challenging market may now be peaking, signalling some relief for drivers in 2024. If inflation continues to slow next year, with the cost of second-hand cars and repairs stabilising, this may feed through to less price pressure.”

Steve Dukes, CEO at Confused.com comments: "For a second consecutive quarter, premiums have increased so rapidly that we're seeing the highest prices recorded across all areas of the UK. That’s because insurers are having to deal with a lot right now, such as an increase in claims and having to price for more expensive cars on the road - such as electric vehicles.

Press Release

“As these adjustments happen, there will come a point where we see price growth settle. But when we look at how prices are affecting drivers right now, insurers need to be doing more to keep prices affordable. Otherwise there’s a real risk that a large number of drivers could be priced off the road as motoring costs become unaffordable.”

|