Less drivers on the road means extra competition for insurance sales, causing insurers to lower premiums, while fewer miles driven has led to fewer claims - which makes insurance more profitable and allows providers to reduce prices and pass this benefit on to customers.

The average cost of fully comprehensive insurance in the UK fell by £73.32 to £417.06 in Q1 2021 (-15%), which represents the biggest quarter-on-quarter drop on record (Q1 2013 to present).

During the eight-year period analysed; premiums were cheapest at the beginning of 2014 when they stood at £405.47 on average. Since then, prices have fluctuated, reaching a high of £581.77 at the end of 2016.

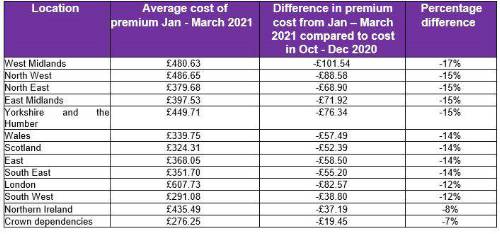

From January to March 2021, every region across the country has benefitted from a dip in the average cost of fully comprehensive premiums.

In the West Midlands, policies were £101.54 cheaper between January-March 2021 than they were from October-December last year on average, representing a 17% fall in costs. This is the largest drop of anywhere in the UK, with Yorkshire and the Humber, the North West, the North East and the East Midlands all seeing prices fall 15%.

Elsewhere, those within the Crown Dependencies region of Jersey, Guernsey and the Isle of Man (-£19.45), Northern Ireland (-£37.19) and South West (-£38.80) saw the smallest change in their premium costs for fully comprehensive car insurance.

Percentage difference of average cost of fully comprehensive car insurance premiums by region

Premiums for fully comprehensive car insurance are cheapest on average in the Crown Dependencies (£276.25), as well as the South West (£291.08) and Scotland (£324.31). They are most expensive in London (£607.73).

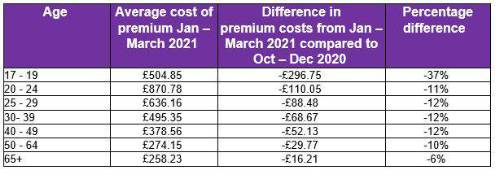

Looking at age groups, premium costs have taken the biggest dip for drivers aged between 17 and 19 - down by more than a third (37%) compared to the last months of 2020, costing £504.85 on average. Driving tests have been cancelled until current lockdown measures are eased, and fewer new young drivers mean that average premiums have dropped sharply for this age bracket.

Fully comprehensive car insurance is the most expensive for drivers aged between 20 and 24, who pay £870.78 on average. However, this is still down 11% from £980.82 in the last three months of 2020.

Andy Teasdale, car insurance spokesperson for MoneySuperMarket, commented: “Our research shows that prices fell significantly in the first three months of this year, with the drop in average premiums the biggest recorded during the eight years we’ve been tracking prices. A trend we can put down to car owners driving fewer miles during the pandemic.

“Extra competition for sales is causing insurers to lower premiums, as fewer claims means that insurance is more profitable and providers can therefore reduce prices and pass this benefit on to customers.

“It is great to see these savings being passed onto customers, however it is likely the bubble will burst at some point as lockdown eases and driving – as well as accidents and claims – start to rise again. The latest view is that restrictions will be eased by the end of June this year and many people will return to the workplace.

“It is unclear how many of those who have been working from home during the last year will potentially reduce their time in the workplace. If there is a significant shift, it could mean that we can enjoy lower premiums for longer.

“If your policy is up for renewal, the best way to make sure you’re getting the right policy for your needs, and at the right price, is to always shop around for a better deal as doing so can save you up to £217.

“Start researching new policy prices a month before you are due to renew, as committing to a purchase in the 15-28 day window before your renewal date could save you on average 17% vs renewing a day before your new policy is due to start.”

You can find out more about car insurance prices and how they have changed across the UK on the MoneySuperMarket website.

|