Drivers saw their premiums increase by £49 on average – up 17% from 2020 when drivers claimed to see an average increase of £42. 15% saw jumps between £26 and £50, while one in 10 saw rises between £51 and £75 (11%), and £76 and £100 (12%).

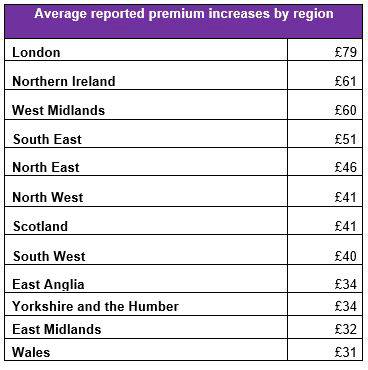

Regionally, drivers in London reported the biggest average rises to their premiums at £79, followed by drivers in Northern Ireland (£61) and drivers in the West Midlands (£60). Welsh drivers saw their premiums increase the least.

Of those surveyed that renewed their car insurance, a quarter (25%) shopped around but stayed with their existing provider for ease - up 20% on last year. Over a tenth (14%) believed that changing car insurance provider takes too much time or effort, and nearly one in five (19%) do not believe there are significant savings to be made.

Despite FCA rules intended to ensure providers highlight a customer’s previous year’s premium price against their renewal price, 48% of drivers do not recall seeing these notifications. Of those that did remember seeing the notices (52%), 72% said that they did not encourage them to shop around.

Sara Newell, car insurance expert at MoneySuperMarket, commented: “Last year more drivers renewed their car insurance with their existing provider than did not. With motorists reporting average premium increases of £49, this means that collectively, UK drivers overspent on their premiums to the tune of an estimated £830 million.

“While we have seen the introduction of the FCA’s new rules on price walking – which are intended to level the playing field for consumers – it’s important that drivers don’t rely on such measures to reduce their premiums.

“We’ll monitor the impact of the FCA’s new measures over the coming months but the fact remains that shopping around is always going to be the most effective way of keeping your costs down.”

|