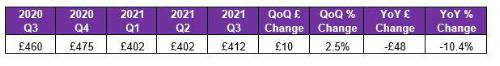

Following a major drop in car insurance prices at the start of the year, the Q3 rise suggests that prices are increasing as more and more Brits hit the roads for work. Despite this, year on year prices are still down by 10.4% equivalent to £48.

Looking at premiums nationally, drivers in London continue to have the highest premiums at £595. Drivers in the capital are followed by those in the North West (£489) and those in the West Midlands (£477). Drivers in the South West pay the least (£298)3.

The region that has seen the biggest quarterly increase in prices is the East Midlands, with a a rise of 4.5% - equivalent to an average jump of £17. The East Midlands is followed by the South West (4% equivalent to £11) and Scotland (3.5% equivalent to £11). Drivers in the North East expierenced the smallest increase at 1.1%, equivalent to £4.

When it comes to age, younger drivers aged 17-19, 21-24 and 25-29 were the only age groups to see quarterly price falls of 1% (£3), 1.6% (£13) and 1.6% (£10), respectively. All other age groups saw price rises, with drivers aged 40-49 seeing the highest quaterly premium increases of 1.8%, equivalent to £7.4

Kate Devine, car insurance expert at MoneySuperMarket, commented: “Following significant drops in average premiums prices at the start of the year, prices might be on the rise as the economy re-opens and more of us return to our cars.

“Regionally, we continue to see big differences in costs with cities like London seeing higher premiums than more rural places such as the South West. This is because insurers factor in a driver’s location when pricing policies – so if you’re in a built up area, you’re perceived as having higher exposure to accident risk.

“Age, too, also has a bearing, with drivers aged 40 plus seeing the biggest premium increases. This is probably due to older drivers being on the roads more which increases their risk factors.

“The good news is that wherever you live and whatever your age group, it’s quick and easy to save money on your car insurance. To avoid higher costs, make sure you don’t let your policy auto-renew and shop around for the best deals early – doing so could save you up to £253.

|