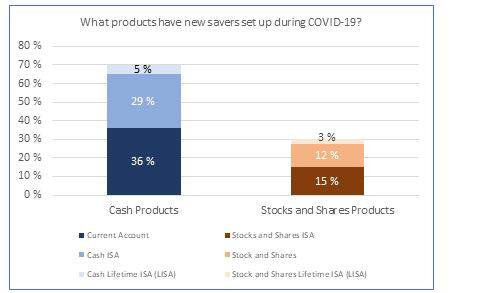

Current accounts were the most popular cash-based products followed by cash ISAs, with 36% and 29% of new savers choosing these products respectively. 15% of new savers chose stocks and shares ISAs, the most popular stocks and shares product.

The research also looked at the way individuals who already have investments have changed the mix of cash and stocks and shares during the current crisis. Four in ten (40%) of these individuals have changed their mix of cash and stocks and shares, with 17% increasing the share of cash and decreasing the share of stocks and shares and 23% decreasing the share of cash and increased the share of stocks and shares.

Younger age groups are most likely to have increased their share of stocks and shares over cash. 6 in 10 (59%) aged 18-34 have decreased cash holdings and increased the proportion of stocks and shares since the beginning of the crisis.

The research further highlights an investment gender split, both amongst those who have set up new stocks and shares products and amongst those who have changed the mix of cash and stocks and shares. Over a third (35%) of those setting up a new stocks and shares product were male compared to less than a quarter (24%) of females. Of those who have changed the mix of cash and stocks and shares, over a quarter of males (27%) have decreased cash holdings and increased the proportion of stocks and shares compared to 16% of females.

Steven Cameron, Pensions Director at Aegon, comments: “The coronavirus crisis has caused significant financial difficulty for many and has affected people’s ability to save. But for some, lockdown has meant a reduction in expenditure, with savings on costs such as childcare, commuting or eating out leading to an increased disposable income. Those setting up new savings products are faced with the choice of keeping money in cash which is attracting record low interest rates or looking to stocks and shares at a time when markets are volatile.

“Aegon research shows cash remains the default for those setting up new savings products since the beginning of the crisis. Availability and simplicity could be behind this, but the coronavirus has also highlighted the importance of a ‘rainy day fund’ with easy access for periods of financial difficulty. However, with most cash product interest rates sitting just a fraction above zero, savers need to think carefully about leaving money in cash over the longer-term with the eroding effects of inflation on the value of savings.

“The research also highlights the ongoing gender gap that exits when it comes to investing in stocks and shares. Males are more likely than females to have set up a stocks and shares product or to have increased the proportion of stocks and shares compared to cash since the beginning of the crisis.

“Saving for the future has never been more important, and the choice between cash and stocks and shares is arguably more difficult than ever. Building up a bigger rainy-day fund in cash is a good start but for the longer term, investing in stocks and shares offers the potential for higher above inflation returns. For those not confident making their own investment decisions, it can often pay to seek financial advice. This can help individuals gain a better understand of their personal attitudes to investment risk and build confidence that a chosen strategy can deliver in line with their goals.”

|