CDC (Collective Defined Contribution) should be designed to encompass a range of risk sharing options which can deliver good member outcomes claims Hymans Robertson in its new paper ‘DC: Developing a framework for the next government’. It argues that CDC should be approached innovatively and include different options, from whole of life CDC through to decumulation only market-based CDC. The leading pension and financial services consultancy also warns that innovation of the scale needed for the success of CDC will take time, effort and ingenuity.

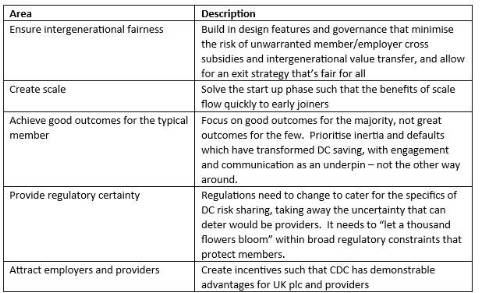

With the end of this parliamentary term in sight, and the expectation that CDC will be supported by whichever party forms the next government, the paper sets out developments that should be adopted following the election. These focus on ensuring intergenerational fairness, creating benefits through scale, harnessing inertia to create good outcomes for the majority, as well as the need to attract employers and providers to support and adopt CDC. There will also be the need for clear regulation that provides certainty, yet allows for the vital innovation.

Commenting on the benefits of CDC but the need for innovation and diversity in its design, Paul Waters, Head of DC Markets, Hymans Robertson, says: “The government is giving a lot of encouragement to CDC and there’s clearly a need to help savers boost their retirement income. CDC is an opportunity to deliver better pensions. It could help millions of savers, reduce the burden of decision making on members, share risk equitably between members and employers, and re-establish the social contract between generations.

“And the opportunity to pool longevity risk through CDC solves one of the biggest challenges facing DC savers. CDC will allow members to spend a set pot of money effectively over a time horizon that could easily be 3 years or 30 years. It offers the potential to sweat the same amount being saved and deliver higher pensions which is an attractive prize.

“However, for CDC to thrive and be inclusive for the benefit of members and employers, it needs scale and diversity which innovation can provide. Offering a variety of approaches would enable the power of market forces and lead to both choice and good value for money for members. Developing CDC as just a single plan design risks it not being adopted by the majority of schemes and could easily leading to confusion and poor outcomes for savers, by fitting a round peg into a square hole.

“The first CDC plan being launched now should be celebrated. But, as we move forward from this to developing it further, it can, and should, take different forms. UK pension schemes and their members are not homogenous.”

The paper outlines the following areas that any future government hoping to encourage the development of CDC should adopt:

The paper can be found here.

|