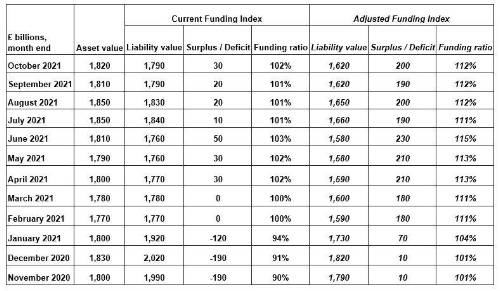

Asset values increased slightly over October while liability values remained stable, resulting in a surplus of £30bn based on schemes’ own measures. This now makes for nine months of aggregate surplus for the UK’s DB scheme universe.

PwC’s Adjusted Funding Index incorporates strategic changes available for most pension funds, including a move away from low-yielding gilt investments to higher-return, cashflow generative assets, and a different approach for potential life expectancy improvements which are yet to happen. This measure shows a £200bn surplus.

Raj Mody, global head of pensions at PwC, said: “As funding positions continue to improve, pension schemes should make sure that their asset strategy will stand them in good stead in the future. For example, climate risk poses a threat to future returns on certain types of investment. In light of COP26 and climate-related disclosures, there is ever increasing focus in this area. More sponsors and pension fund trustees are looking at how they can target net zero for their pension schemes as well as in their business operations. Inevitably given the practical complications and supply constraints, only a minority have addressed all the issues.”

PwC asked attendees at their most recent Virtual Ideas Exchange event, attended by around 150 pension fund representatives, whether they had considered the risks and opportunities presented by climate change to pension schemes. While 1 in 10 respondents had done so and put a practical solution in place, the remainder had either not yet considered it or not got very far in terms of practical actions.

Laura Treece, pensions actuary at PwC, added: “There are complex issues for trustees to work through in making decisions about how to manage climate risk within their scheme investment strategy. But if the industry doesn’t collectively take action, economic growth and future returns for every pension fund are at stake. Not only that, schemes could miss out on opportunities to optimise returns - sustainable assets are well placed to provide future real returns as the UK works towards net zero. Those pension funds looking to transfer to an insurance company might also find that ‘green’ assets are more desirable, which may help them secure members’ benefits more quickly.”

The PwC Pension Funding Index and PwC Adjusted Funding Index figures are as follows:

|