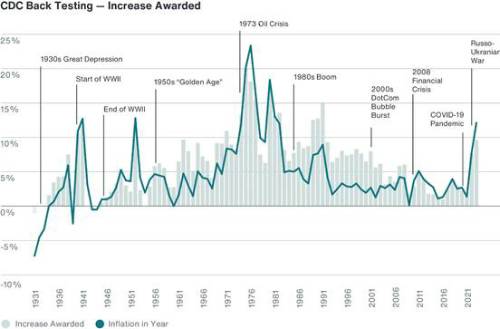

This conclusion was reached after updating ‘Collective DC in adverse markets’, Aon’s analysis from 2020 which assessed how CDC schemes would have fared over the last 90 years of economic rise and fall.

Chintan Gandhi, partner and head of Collective DC at Aon, said: “Our updated analysis and expanded chart, below, revealed that a well-designed CDC scheme would have continued to withstand the market turbulence of the last two years without cuts to members’ benefits.

“Based on the experience of 2022, a CDC scheme was expected to provide an increase of over 9 percent to members’ target pensions. That’s not quite matching the prevailing rate of inflation, but not far off.”

Chintan Gandhi continued: “The nature of a CDC scheme means that members’ target pension increases can be adjusted to reflect positive and negative experience over a period of years. This means that the impact of market movements – in either direction – are shared between members and then smoothed over time.

“By contrast, defined benefit (DB) pension schemes generally provide guaranteed increases to members’ benefits - although many apply a cap to increases. For example, this can be of 2.5 percent or 5 percent each year depending on the scheme’s rules and/or when members accrued their service.

“Given CDC schemes are expected to hold a significant proportion of growth assets, it’s likely that CDC schemes would not have been invested in a way that led to the liquidity pressure seen in many closed DB schemes during 2022 - the result of rising gilt yields.”

Madalena Cain, associate partner and Collective DC specialist at Aon, said: “Our analysis also shows that DC pension pots would have struggled to see returns matching the level of inflation this year. For DC savers invested in bond-based strategies approaching retirement, rising yields have led to a fall in their DC pot. For the 10 percent of these savers who typically buy an annuity at retirement, they may still be able to secure broadly the same level of retirement income as before, given annuity pricing moves in the opposite direction to rising yields.

“However, the majority of those retiring exclusively with a DC pension pot would be likely to face the very real challenge of retiring on less than they expected or having to work longer.

Madalena Cain continued: “While much has been said about annuities becoming more attractive, it is all relative, as our recently published The Power of Pooling analysis and our 2013 whitepaper, The Case for Collective DC, revealed. CDC is expected to provide on average over 30% higher outcomes than DC where annuities are used to secure a lifetime income.

“Also, for the 10 percent of DC savers who buy an annuity at retirement, the majority buy the single-life, non-increasing - flat - type.

Against the backdrop of high inflation, flat annuities may not be a particularly good fit for retirees’ needs, while single-life products provide no contingent benefit for those survived by the member. By contrast, CDC schemes are required at the outset to target increases at the least in line with inflation - and we expect them to offer dependants benefits on death.”

|