By Esther Hawley FIA, Associate, Barnett Waddingham

Size matters

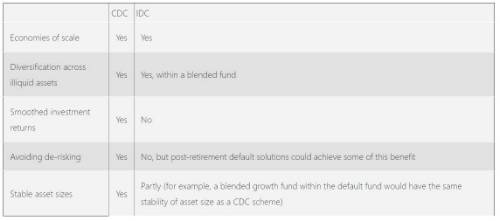

One of the main factors identified as contributing to the improved outcomes was economies of scale leading to reduced administrative and investment costs. However, this will also be achieved through our existing DC schemes, and in particular master trusts, as they gather greater scale. Arguably, IDC schemes will in fact have the edge here, as the costs of valuing benefits and calculating increases are avoided.

Diversification and illiquid assets

Diversification is a key tool for managing investment risks cost-effectively and being able to extend investments to illiquid assets will therefore be advantageous for any pension scheme. Not only would illiquid assets provide added diversification benefits, but the higher expected returns offered by illiquid assets are also an attractive prospect, as the longer investment horizon needed for illiquid investment is a small price to pay for members who will not need to access their benefits for many years to come.

Most IDC schemes will already use a certain level of diversification and in fact, the larger schemes we advise at Barnett Waddingham also have allocations to illiquid assets. New funds mean that it is now possible to access illiquid asset classes through a platform-friendly pooled fund structure, and by including a small allocation to illiquid assets within a blended growth fund, it is possible to maintain the fund’s overall liquidity even where gating restrictions might apply to the illiquid portion. So IDC schemes can now also benefit from more illiquid allocations.

Smoothing returns

A key feature of CDC schemes is the smoothing of investment performance, so returns in “good” years are held back to fund better returns in “bad” years. It would technically be possible to smooth investment returns within IDC also – after all this is essentially what a with-profits arrangement will do. However, there is a reason why with-profits investments have fallen out of favour: they are complex to operate and hard to understand. It is difficult to see therefore that a new generation of IDC schemes, which are built on simplicity and transparency, could adopt any form of investment smoothing.

The ability of CDC schemes to smooth returns consequently provides a more stable investment journey for members, but careful consideration would be needed to ensure they do not fall foul of the same issues as with-profits funds. A particular challenge when looking to smooth volatility is being able to distinguish between a downward blip, and the start of a longer downward trend.

Avoiding de-risking

A key benefit of CDC is the ability to avoid de-risking in the run-up to a member’s retirement, allowing them to enjoy growth-style returns for longer. This is one area where IDC will never be able to follow fully, as an individual member will always need to look for increased stability around retirement and as they start to draw down their funds. Research published by the Pensions Institute, has estimated that the cost of this de-risking approach is around 15% for a typical 10 year de-risking strategy, so this is a material difference. However, it is foreseeable that a new generation of larger IDC schemes, where some of the techniques from CDC could be adopted in an IDC environment.

For example, default post-retirement solutions, could provide a compromise between managing the risks faced by members and allowing them flexibility. Where members are not looking to purchase an annuity, default allocations could include greater allocations to growth assets at older ages, mitigating some of the need for pre-retirement de-risking. For those members who do purchase annuities perhaps later in life, a post retirement default structure could allow annuities to be purchased in bulk. This delivers better value through the increased negotiation power of a large scheme compared to an individual member. The difference between CDC and IDC may not therefore, be quite as big as it might first appear.

Stability

CDC schemes have a number of challenges for example, the extra complexity associated with operating a CDC scheme compared with an IDC scheme will generally require more administration and have higher governance costs a further challenge facing CDC schemes is communication with members. The complex risk-pooling required for the benefits of CDC schemes to be realised is generally more difficult to communicate.

There are many reasons therefore, why CDC may prove to be unpalatable or unsustainable in the future, not least as fashions change and come round again. If pension scheme history has taught us anything, it is that nothing lasts forever. We should plan now for how arrangements we put in place today, can be sustainably run down or wound up in the future. In the case of CDC, doing this would negate a lot of the benefits. Finally, the benefit of CDC being a stable asset pool with future contributions replacing pensions paid is not in reality all that different to an IDC scheme with a default solution – pre and post retirement - that is managed on behalf of all its members.

Conclusion

In summary, many of the benefits brought by CDC could be replicated in large-scale default solutions run by individual DC schemes, and without the attendant operational complexities nor concerns about exit strategies. That said, CDC schemes represent progress. This is another tool in the box for providing pensions, which provide cost-effective risk management for both members and employers. I hope that today’s large IDC schemes can follow suit and mirror the developments of CDC in such a way, that they too can improve the overall outcome for the UK’s pensioners.

|