Andrew Tully, technical director at Canada Life commented: “IHT is no longer a tax only on the wealthiest estates. As these record figures show, IHT has now become a mainstream tax on ordinary people, largely due to house price increases. With record amounts being banked by the Chancellor, and with the OBR forecasting IHT receipts will grow to a massive £8.4bn by 2027/28, people need to put their finances in order to avoid the tax man taking more than his fair share. Only then can people be confident they are passing on their wealth to their beneficiaries as tax efficiently as possible.

“Simple things such as setting up a trust, making use of gift allowances, and using your pension to cascade wealth very tax efficiently, can all help manage the value of your estate for IHT purposes.”

“The tax free allowance is £325,000, so if you suspect your estate might be worth more than this, it is worth your while seeking expert financial advice. Don’t get caught out based on the assumption that you don’t have enough wealth to be hit by IHT.”

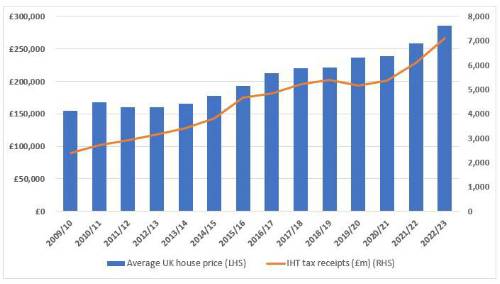

Yearly IHT receipts and average house price growth since 2009

Source: Canada Life

To read the latest update from HMRC in full, please see here

Stephen Lowe, group communications director at retirement specialist Just Group, commented: “Inheritance Tax receipts stormed to record highs this financial year as the Chancellor continues to benefit from frozen thresholds and soaring property prices through the pandemic.

“There seems to be no limit to the Treasury’s appetite for Inheritance Tax and given receipts for this financial year have already surpassed upgraded estimates, it looks set to be the goose that lays golden eggs for some time yet.

“It’s important that people regularly assess the value of their estates, including an up-to-date valuation of any owned property. Professional, regulated advice can also help people work out the total value of their estate, calculate how much tax they may be likely to owe and understand what options they have to manage that tax bill.”

|