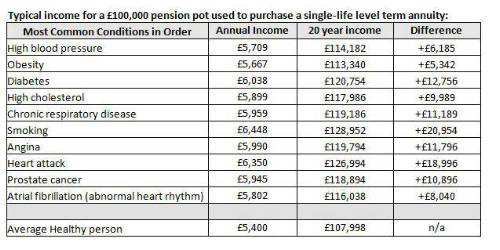

The most common condition that people declare when taking out an enhanced annuity is high blood pressure followed by obesity, diabetes and high cholesterol. All of these conditions can be relatively minor and treated with medication but mean that people can receive almost £21,000 more income assuming a 20-year retirement.

While approximately 65% of people may be eligible for enhanced annuities, the perceived complexity of sourcing a quote and reluctance to divulge private information was often seen as barrier prior to the introduction of the Pension Freedoms.

New research suggests that this is not necessarily correct as over half (64%) of 40 to 70 year olds said they would be more than happy to disclose a wide range of personal, financial and lifestyle data* if it helped them gain a better understanding of how long their retirement might be.

Of those who were reluctant, 17% said they would not be keen on providing personal medical history, 16% would not share their salary and 15% did not feel that they wanted to divulge their hobbies and social relationships. Mental health (15%) and family medical history (14%) were also topics people were less keen on discussing.

For those consumers who are willing to provide information, the Retirement Health and Lifestyle forum is providing access to the form used by enhanced annuity providers. This will provide people with the opportunity to see if they may be eligible for an enhanced annuity and prepopulate the form prior to speaking to their adviser.

Mark Stopard, Head of Product Development, said:

“Under the new pension freedoms, people do not have to take out an annuity but many people still want a guaranteed income for life. An annuity remains one of the best ways in which people can secure this benefit so if people do want to take out one of these products; they deserve to get the highest income possible. Shopping around and looking at whether they are eligible for an enhanced annuity will ensure that they get a better deal than they might have if they stayed with their existing provider.

“Many of the most common conditions that we underwrite for can be relatively minor and managed with medication but can make a real difference to the amount of income someone receives. If someone is considering this route, visiting the Retirement Health and Lifestyle forum website will give them an idea of the questions they may be asked and allow them to gather the information they need prior to speaking to their adviser.”

|