Typical commuter carries nearly £2,000 in personal possessions to and from work

Central Line is most ‘valuable’ tube line on the London Underground

Nearly 1 in 10 workers have lost their phone, jewellery, gloves or laptop on their commute

The research showed that possessions carried on commuter trains during rush hour, including laptops, smart phones, wallets, jewellery, bags and office clothes, add up to £1,815 per commuter – and with the average commuter train carrying 515 passengers* into London, the combined value reaches a staggering £934,725.

With 40 per cent of commuters taking a tablet or laptop with them on their journey to and from work and 88 per cent carrying a smartphone, the average value of the electronic items is £632 per passenger. On top of this, the items we keep in our bags – such as glasses, make-up and perfumes – are worth £327 and accessories such wallets, purses, jewellery, watches, and other clothing add on another £856.

But 43 per cent of commuters do not have insurance to cover losing any of their possessions, a figure that is more alarming given 15 per cent have lost their wallet while on a journey and 9 per cent their mobile phone, while others have lost jewellery (11 per cent), umbrellas (17 per cent), gloves (12 per cent) and laptops (7 per cent).

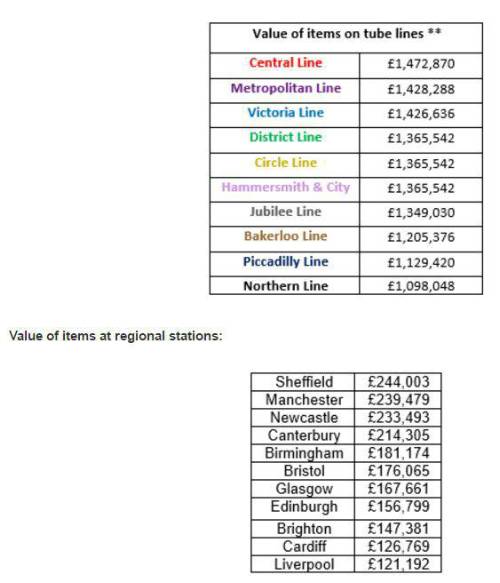

In central London, the value of possessions on rush hour tube journeys is even higher. The Central Line is the 'richest,' with the value of laptops, phones and other personal items adding up to a total of £1.5 million. The Metropolitan and Victoria Lines are the next most valuable tube lines.

Kirsty Wainwright-Noble from Towergate, said: “It is alarming to think about the combined value of items we carry to and from work each day without a moment’s hesitation. But with many of us using various modes of public transport to get to and from work, there is a risk of valuable items being left behind and ending up in a station’s lost property. It’s crucial that commuters check they have the right cover in place and if unsure speak to their insurer about what they are covered against outside of the home; otherwise they could find themselves increasing an already costly commute”.

Towergate has captured these findings in a fantastic infographic which illustrates the value of commuting, here |