-

FRS17 and IAS19 scheme liabilities jump 15% in July

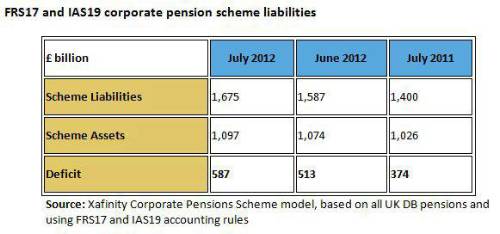

The UK’s Defined Benefit pension scheme deficits have jumped 15% in July as corporate bond yields crash towards gilt yields, according to Xafinity’s Corporate Pensions Scheme model.

Companies reporting this December will be facing a staggering 65% increase in their reported deficit unless the next five months can reverse the trend and bring some good news, according to FRS17 and IAS19 accounting rules.

Following four months of relative pension scheme stability, corporate yields have now crashed through 4%, lower than at any time in the history of the accounting standards, which has caused liabilities to jump by almost £100bn in just a month, far outweighing the 200 point rise in the FTSE100.

Should this trend continue uncorrected, corporate sponsors will suffer severe consequences in the profits they can report. Changes under IAS19 rules will lead to a fall in the credit in the P&L for returns on scheme assets, and a large deficit means interest charges will also create significant hits to the P&L.

Hugh Creasy, Director at Xafinity Corporate Solutions, said: “The Jubilee and Olympics have brought little cheer for companies with defined benefit pension liabilities. For four months we have seen stagnation of the deficits at over half a trillion pounds, which was alarming enough for companies, but the recent crash in corporate bond yields could spell disaster as companies may be faced with reporting jumps in their deficits of around 65 per cent.”

|