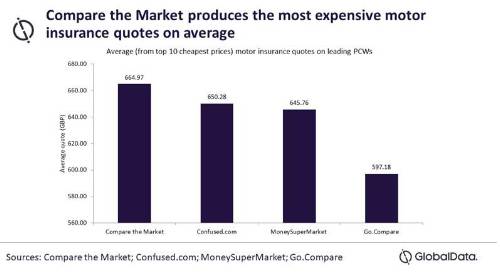

According to GlobalData’s 2022 UK Insurance Consumer Survey, Compare the Market is the most frequently used PCW within motor insurance, with a 54.5% share of the market. MoneySuperMarket ranks second (14.8%), followed by Go.Compare (13.9%) and Confused.com (12.6%). However, GlobalData research has shown that the site with the highest average motor insurance quote (from the top 10 cheapest) is Compare the Market at £664.97, while Go.Compare produces the cheapest quotes for motor insurance at an average price of £597.18. Additionally, Flow produced the cheapest quote across all four comparison sites.

Charlie Hutcherson, Insurance Analyst at GlobalData, comments: “Given that Compare the Market provided the most expensive quotes on average, its strong market share is likely due to a highly successful marketing strategy along with the incentives that it offers its customers. As per GlobalData’s 2022 UK Insurance Consumer Survey, 12.7% of respondents said they chose a PCW because they wanted a reward/promotion that was offered. The brand of Compare the Market is symbolized by two meerkats, and it advertises its site by giving away movie tickets and restaurant deals.”

Additionally, the price differential of quotes on PCWs has diminished in 2023 compared to 2022 and 2021. This is likely because the Financial Conduct Authority (FCA) regulations on dual pricing are influencing providers’ ability to undercut each other (and themselves) to win new business. As a percentage of the lowest average quote out of the four sites, the difference between the largest and smallest average quote in 2023 was 11.4% for a motor insurance policy, compared to 12.3% in 2022 and 37.7% in 2021.

Hutcherson concludes: “PCWs must reinvent themselves in order to better meet consumer needs. The new FCA pricing regulations severely limit their ability to promote switching or draw in new customers. If PCWs want to remain relevant in the future, they must develop alternative incentives for users to utilize and make purchases through their sites. Offering value-added benefits is one such strategy. Customers who buy a motor insurance policy through one of the top four PCWs can participate in one of several reward programs.

“Moreover, PCWs need to keep pushing for high levels of site visitors despite declining sales opportunities. Although the market is transitioning into a somewhat inactive phase, PCWs that can enhance their informativeness, clarity, and operability will likely succeed.”

|