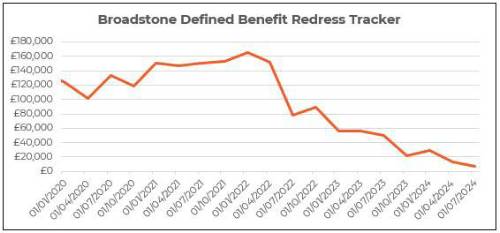

The quarterly Defined Benefit (DB) Redress Tracker from leading independent financial services consultancy Broadstone shows compensation due to those who were previously ill-advised to transfer out of their DB pension continues to fall to record lows.

Broadstone’s DB Redress Tracker follows the example of an individual who left their scheme in 2018 aged 50, with a pension of £10,000 p.a. which would receive inflation-linked increases when in payment. The Tracker is developed in line with Financial Conduct Authority (FCA) rules for calculating redress with the individual assumed to have invested their funds to earn returns in line with the FTSE Private Investor Index.

Yields have continued to increase through the first half of the year which alongside a modest increase in asset returns has led to a further decrease in the redress payable to our notional consumer because the sharp increase in annuity rates means many transferors can secure a higher level of guaranteed income from their pot.

This minimises the financial disadvantage for those seeking compensation after being wrongly advised to transfer their pension, and therefore the redress they are due.

Continued increases in yields through Q2 2024 alongside a slight rise in asset returns saw redress levels decline to around £6,600. This represents a radical decline from the start of 2022 when compensation was over £150,000, due to softening financial conditions as rates soared.

Through the course of this year, compensation has seen smaller declines. Redress levels in Q2 2024 broadly halved compared to Q1 when redress for our nominal transferor stood at £12,600 alongside a larger fall from the end of last year (£29,100 in Q4 2023).

Brian Nimmo, Head of Redress Solutions at Broadstone, said: “Yields continued to rise through the first half of the year which, alongside a modest increase in asset returns, has led to a further decrease in the redress payable to our notional consumer. Time will tell as to what the impact of the new government will be on the markets and whether yields will come back in, which would lead to redress increasing again.

“Redress rates can appear volatile given it is calculated as the difference between two large numbers which can move in separate directions making it tricky to second guess how redress will move in individual cases. With this in mind, and especially as the FCA brings in new ‘Polluter Pays’ reforms, it is vital that financial advice firms remain on top of compensation fluctuations to allocate requisite capital against potential claims.”

|